Inside the Cortland-Elme Megadeal

Cortland has agreed to acquire a large chunk of Elme Communities’ portfolio for $1.6B

Out in the market to score a PE war chest for its M&A quests, multifamily giant Cortland is providing a glimpse of the types of deals that extra money might spawn. The firm has agreed to acquire 19 properties (≈ 6K units, VA-centric) from REIT Elme Communities in a $1.6B all-cash deal, the companies announced today. It’s worth diving into the numbers & players in the mix here, because they say a lot about where institutional multi stands today. So The Promote’s prepared a handy dossier. 📝

What's On Tap - Aug. 4

Cortland-Elme (Cont.)

Pricing: The Promote had heard that going-in pricing on the deal was at a cap rate in the mid-5s, or a shade under $300K/ 🚪. (Cortland typically spends a decent chunk on TLC post-acquisition, so keep that in mind.) A Truist analyst note on the deal seen by The Promote got to a similar place, estimating a 5.6% TTM cap rate. Compare that to EQR’s 5% cap rate on the $962M Sunbelt portfolio acquisition from Blackstone in Q3 ‘24, or KKR’s low-4 cap rate on the $2B Quarterra buy (bougier assets TBF). (Here’s CBRE’s Q2 report to give you a broader sense of the market)

Timing: Closing expected Q4

Advisors: Cortland is being advised on the deal by Evercore, the I-bank that is also advising it on its company-level capital quest. Citi & Morgan Stanley are also in the mix (Side note: Seeing Evercore 💪 its way into more & more institutional multi advisory deals, a trend that should certainly concern the lads at CBRE & JLL who’ve long ruled that niche.) Cortland is also finalizing its debt package for the acquisition, per insiders – we’re still unclear on which lenders are stepping up. Don’t expect trad brokers to be involved there, though, since Cortland has been eschewing the use of them since scooping up VNO’s capital-markets head Jan LaChapelle in ‘23. Elme’s being advised by GS and JLL.

REIT n’ greet: Cortland has danced w/ publicly traded firms before. In ‘19, it snapped up Pure Multifamily REIT in a $1.2B take-private, taking control of 7K units in TX & AZ.

Scale: This deal will push Cortland into the 80K owned units range, but not for long: The firm is in the midst of disposing 4K-ish units it owns w/ JVP Management, as The Promote reported earlier this month; ≈ 2/3 of that portfolio is in contract, to an assortment of FOs and global long-term capital.

Elme also announced that it’ll look to sell its 10 remaining assets (9 MF properties + an office building), and then ride off into the sunset via a voluntary liquidation. It has scored a $520M debt commitment from GS secured by those unsold assets – that financing is contingent on the successful closing of the Cortland transaction. 🌆 Elme is one of several big-but-not-big-enough players soul-searching amid a tough financing environment. We dove into the MF capital landscape on the pod 👇

The Promote reported earlier this month that Bell Partners (20-25K units owned, nearly 90K managed) is on the block. One of the names that keeps popping up as a potential suitor for it is BGO. 🛒

More CRE M&A news:

Hines-Rialto JV Strikes in Manhattan

A Hines-Rialto office-focused JV has snapped up 3 NYCB loans

Chalk up another deal to the MSRE mafia… Alums Jay Mantz, the #2 guy at Rialto Capital, and Alfonso Munk, Americas CIO for Hines, are pals who have a history of working together, and have just pulled off a series of intricately choreographed transactions in Manhattan. A Hines-Rialto JV bought 3 loans secured by Hilson Management (Jeremy Schwalbe) properties (185 Madison, 5 West 37th St., 349 Lex) The loans, per PincusCo, collectively had an OG principal balance of $99.8M, w/ NYCB/Flagstar as the lender on all 3. Hilson, founded by Schwalbe’s grandfather, is one of many smallish office players facing portfolio-wide challenges from tough capstacks. Do these note buys set the stage for deeds-in-lieu + hope notes, as has been the case for many troubled Class B & C office properties recently? Or will there be a more drawn-out legal fight to take control? (See also: Rialto Ratchets Up the Heat)

The Hines-Rialto JV is eyeing a total raise of $2.5B for credit bets, exclusively focused on office. One of its anchor investors in the fund is the Canada Pension Plan, which has been retreating from its equity-side bets in the same space.

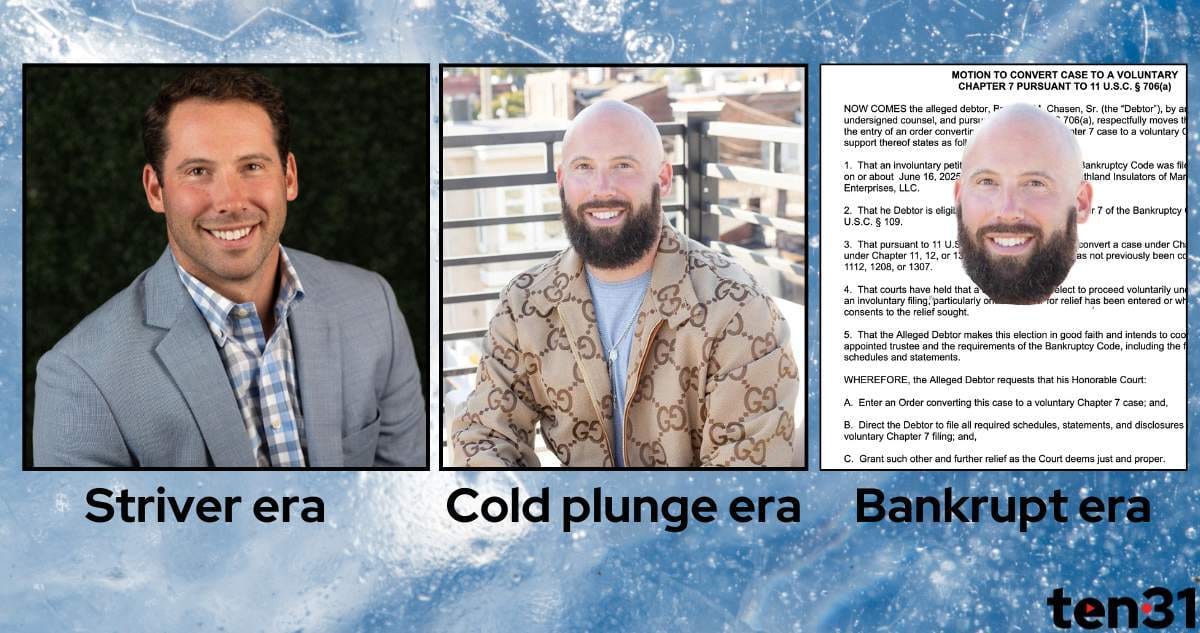

Baltimore Hotshot Enters Bankruptcy

Once hotshot Baltimore builder Brandon Chasen has agreed to enter bankruptcy

It's Baltimore. No one lives forever. - Tommy Carcetti

Brandon Chasen, the once-hotshot Baltimore developer who spent the last year and change fighting off creditors and giving back properties, has agreed to enter Ch. 7 bankruptcy. A trio of creditors including Sandy Spring Bank had moved in June to force a bankruptcy, so that Chasen’s possessions (Smurf blue Rolls-Royce Cullinan, Gulfstream G200) could be sold off to pay them back.

Chasen’s attorney Adam Freiman told the Banner that Chasen “has not, at any time, attempted to hide assets or evade legal responsibility.” He blamed his client’s financial troubles on an “unprecedented combination of external pressures:” Covid, interest rates, even the collapse of the Francis Scott Key Bridge (btw a GREAT Odd Lots on the bridge incident here). Chasen was one of the city’s most prominent developers, both because of his shop’s scale (at its pomp, it owned 10% of Fells Point’s MF stock, per the Banner) and his YOLO lifestyle – he dialed both back last summer, saying he had “adjusted for longevity.”

Now the Q becomes: Will the Ch. 7 be the coda to a flashy career, or merely a convalescence? Per his lawyer, it’s definitively the latter. “Once this process concludes,” Freiman said, “[Chasen] hopes to apply the many lessons — both painful and profound — he has learned to build again, contribute again, and demonstrate that redemption and renewal are possible.” 🙏 🧊

Cush Pushes Digs to Paramount’s Midtown Joint

Cushman & Wakefield is moving its NYC offices to Paramount Group’s (yes, that Paramount) 31 West 52nd St., per CO, signing for 130K sf across 5 floors. As a sweetener, the brokerage will also lead leasing efforts at the 770K sf tower. CEO Michelle MacKay, who’s overseen Cushman’s balance-sheet babysitting ™ efforts, will be based at the new digs, though HQ remains in Chicago.

Some essential color here: When Cushman had made its decision to exit its current digs at Vornado’s 1290 Ave of the Americas, it was in talks to move to Brookfield’s 660 Fifth (fka 666 Fifth). But when it backed out of that move in late ‘23, Brookfield retaliated by firing the firm from its office and logistics listings. 🍽 🥶

Quickies

Unquotable Quotes

“Forget financial papers – you’d go to TMZ and they’d be like, ‘Office buildings in New York in distress!’” ⏰ ⏰ ⏰ ⏰ ⏰ 🔥

- SL Green’s Harry Sitomer, on the schadenfreude in NYC office coverage