Flow’s Pref Hunt Continues

Adam Neumann’s Flow is marketing 2 more distressed rental towers

When it comes to Adam Neumann, we are well aware that pesky details such as cash flow and operating profit don’t really matter as much as they do for the rest of you. The greatest salesman in modern capitalism recently doubled the valuation of his multifamily company Flow, despite much of its portfolio being in dire need of rescue pref. Flow is in the midst of bringing in multi giant Cortland in for a pref piece at a 425-unit tower in Atlanta’s tony Buckhead nabe. It also recently sold 2010 West End Ave in Nashville to Tishman Speyer for $112M, or $313K/ 🚪 - that btw was a short sale, below the $121M CIM debt on the property. It’s important to note that the main bagholder on that one was crowdfunding platform YieldStreet (anyone noticing a pattern here?), which put up most of the equity on the $159M ($444K/🚪) purchase of the property in Dec. ‘21.

What's on tap - May 19

Powered by: AirGarage

Boost your NOI by 23% on average by switching to AirGarage’s full-service parking management solution. AirGarage is the data-driven parking operator, using License Plate Reader cameras to power dynamic pricing and maximize revenue at your parking facility.

Readers of The Promote can get their first 2 months of management fees waived* when they switch to AirGarage. Contact us now to get a custom proposal for your facility.

* Offer valid until 8/1/2025

Flow (Cont.)

Two more properties in play, sources familiar w/ the matter told The Promote, are the 268-unit Stacks on Main in Nashville, which Flow bought for $79M ($295K/🚪) in summer ‘21 and then landed $60M+ debt on from Rialto ; and the 290-unit Trace Midtown in Atlanta. Meanwhile, Flow has persuaded Israeli investor Canada Global to back its 3-tower, 675-unit ground-up project in Aventura. We broke down Flow’s adventures in more detail on the pod recently 👇

Traveling HFC Hail Mary: SB 867

On Friday, we dove deep into the passing of the most punitive version of a Texas bill that would put an end to one of the strangest property-tax loopholes we’ve ever seen, Traveling HFCs. That bill, HB 21, includes a retroactive component that would upend the capital markets and leave a wave of distressed multi properties in its wake. However… there is a more palatable cousin of the bill that is now on the legislature’s intent calendar: SB 867, also sponsored by Sen. Bettencourt, also seeks to unwind Traveling HFCs, but crucially does not insist on retroactivity. The bill, as industry lobbyist Todd Kercheval described it in client comms reviewed by The Promote, “has most of our language in it, certainly a bill that we could live with!” Here’s the sauce: HB 21 flew through the House and Senate and is now bound for the governor’s chambers, as we reported. BUT if SB 867 makes it through both chambers as well, then things will get v interesting: Gov. Greg Abbott will have to pick which one he signs, and which one dies a silent death. To help him make this choice, the industry might hope for a little help from its powerful friends. Remember that HUD Secretary Scott Turner was formerly “chief visionary officer” for major Texas-based developer JPI, and JPI’s former owners went on to form TDI, which has used the Traveling HFC program.

Howie Out

Newmark is buying out Howard Lutnick’s stake in the firm for $127M

Howie Lutnick, who long reigned over Newmark as exec chairman and empowered Barry Gosin to spend big to bring in talent from its rivals, has made good on his promise to divest after heading to the White House: Lutnick, now the US Secretary of Commerce, is selling his roughly 11M shares back to Newmark for $127M, the brokerage announced Monday. He held just 11% of the stock, but had more than half the voting power given that his shares had Zuck-esque 10:1 voting power. Gosin, who’s been at Newmark for 45Y and recently signed a contract extension w/ a pay bump through ‘26, will now fully call the shots. Lutnick’s holdco Cantor Fitzgerald is now controlled by his trusts benefiting his sons Brandon and Kyle.

Never Call Office REITs Boring Again

Paramount Group, in the thick of governance scandal, is embarking on a strategic review

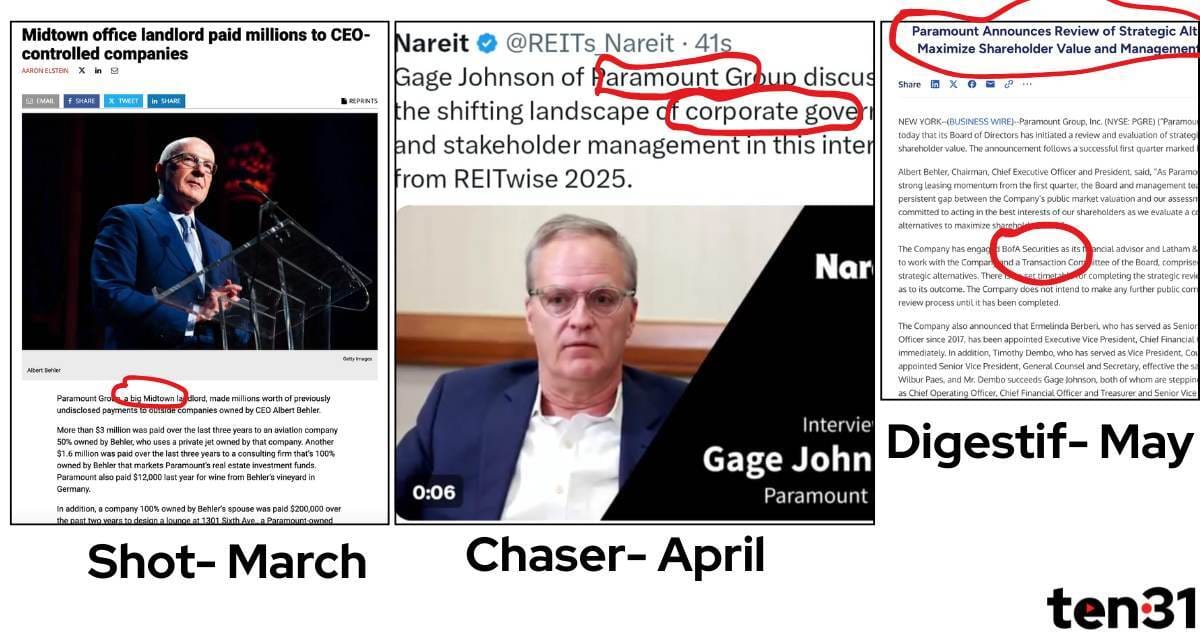

Absolute 🍿 scenes at Paramount Group, a major office REIT that controls 13M sf in Manhattan and SF: In March, the firm disclosed it had made millions of dollars in prev. undisclosed payments to outside firms controlled by its CEO Albert Behler, for services ranging from the sublime (Behler’s aviation company ✈ ) to the ridiculous (wines from Behler’s German vineyard 🍷 ). By April, the REIT was looking to put the scandal behind it, and even sent its general counsel Gage Johnson to NAREIT to hold forth on the “shifting landscape of corporate governance and stakeholder management.” A shifting landscape, indeed: Paramount just announced today that it has initiated a strategic review, i.e. an exploration of how it can best maximize its value – this can generally mean anything from an outright company sale to selling off major assets. It tapped BofA Securities to help figure out next steps, and also announced a management shake-up: Johnson is out, to be succeeded by Timothy Dembo; and the COO/CFO Wilbur Paes is being replaced by Ermelinda Berberi. (No word on how the board feels about Behler’s recent adventures.) The firm had a net loss of $10M in Q1, following a $39M net loss in Q4 of last year. Recent bright spots include landing white-shoe law firm Kirkland & Ellis to 131K sf at 900 Third, as well a sale of 45% of that same property at a $210M valuation.

Sush’s Recap Push

Sagehall and TPG are recapping 225 PAS at a $350M valuation

It’s rescue recap season for Manhattan’s fallen-from-grace office buildings – so many of these deals popping up. The latest: Sagehall, a firm founded by Sush Torgalkar (Westbrook vet, Extell CEO for a hot second) & Lanhee Yung (big fundraiser at Starwood), is stepping into 225 Park Ave South, per CO. Sagehall is bringing in TPG on the (Newmark-brokered) recap for the 2-building property owned by Orda Management, which once boasted tenants such as BuzzFeed and Meta but is now largely vacant. The new $350M valuation ($518/ 🦶 )is less than half the $750M ($1,111/ 🦶 ) valuation the property had in ‘17, but an improvement from its late ‘24 appraised value of $217M – at the time, the building had $430M in debt, consisting of a $235M CMBS loan and $195M in mezz from Rexmark. Sagehall also recently stepped in to recap RXR’s 530 Fifth at a $180M valuation.

See also: A costly rescue recap

Quickies

Now that’s a name we haven’t heard in a bit! Defunct Aussie REIT Dixon selling off Brooklyn brownstones 🦘

Mid-market dealmaker Jacob Schmuckler left Meridian in Jan. – worked a lot w/ Morris Betesh and has now officially landed at Betesh’s shop

ICYMI: Axings at both Benefit Street & Freddie

Unquotable Quotes

“You’re Mr. Schuster? I thought you might look a little older based on what the charges are.” 👦 👨

- Judge Valerie Caproni,surprised by the youthfulness of Josh Schuster relative to the Ponzi-like allegations against him (stay tuned for Wednesday’s pod for more)