Who Gets to Rate Your Debt?

Some of the biggest private credit players are icing out a ratings upstart

Some of private credit’s biggest players – those that fund your office refis, your industrial megabets, your data centers yearning to break ground – are taking a Mean Girls approach to one of the most prolific ratings firms in the game.

What's on tap - June 2

Powered by: AirGarage

Boost your NOI by 23% on average by switching to AirGarage’s full-service parking management solution. AirGarage is the data-driven parking operator, using License Plate Reader cameras to power dynamic pricing and maximize revenue at your parking facility.

Readers of The Promote can get their first 2 months of management fees waived* when they switch to AirGarage. Contact us now to get a custom proposal for your facility.

* Offer valid until 8/1/2025

Ratings (Cont.)

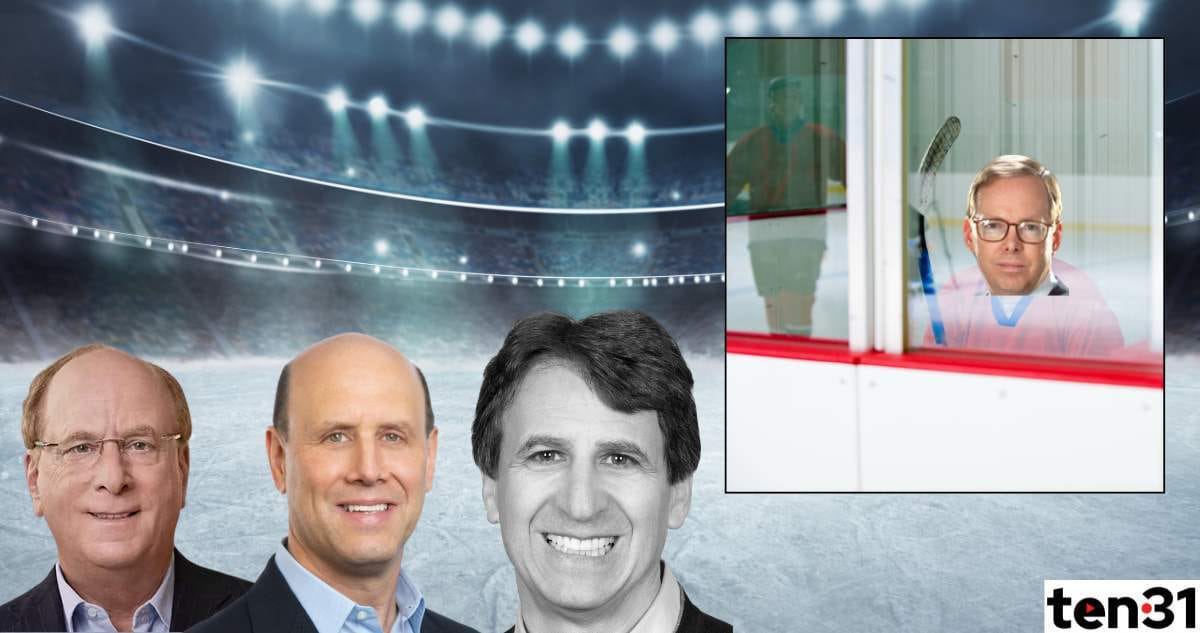

Out of a four-bedroom colonial house in the Philly area, an upstart ratings firm graded more than 3K investments last year in this rapidly growing market, one that in the wake of the regional-bank collapse has become existential to the CRE capital stack. Egan-Jones Ratings Co., headed by early Enron Cassandra Sean Egan, has pulled this off w/ just 20 analysts, per a superb new Bloomberg dive, and bills itself as the biggest ratings co. in the space. Its BBB votes of confidence have contributed to Wall Street’s ability to rake in billions for private-credit bets. In some cases, players actively seek it out to score that huggable rating and lower their cost of capital, per the publication.

Some of the biggest players, however, are wary: Apollo, which via its lifeco subsidiary Athene is ALL over CRE, does NOT use Egan-Jones to rate any of its private credit assets held in its insurance arms. BlackRock & Carlyle have explicitly declared Egan-Jones non-kosher in fundraising docs, as have Blue Owl & HPS (now a BlackRock joint).

“In cases where the amount of information is lower and data is opaque, like in private markets, their model underperforms,” accounting prof Samuel Bonsall told the publication about Egan-Jones’ model. One dramatic example: Egan-Jones assigned a BBB rating to Crown Holdings LLC, controlled by Moshe “if there is no price anywhere it’s good” Silber. The company defaulted just 6 weeks later, and Silber was sentenced to 30 months in prison for mortgage fraud in March.

This Q - who gets to rate your debt? – is a central one in finance. Ratings agencies were among the enabling villains in the GFC, as immortalized in this iconic scene from The Big Short. Soul-searching about their methodologies & friendliness to borrowers is once again happening in CMBS, after AAA bondholders recently experienced losses. With private credit’s ascendancy, expect to see more reflection here, too.

Bonus: Check out our chat on Bloomberg’s Odd Lots about AAA office losses

Raking in the Debt War Chest

A new tally of US CRE’s largest debt fundraisers gives you a preview of the lending action

PERE’s out w/ its annual ranking of the top 50 US CRE private credit managers, who collectively raised just under $175B in the 5Y period ending in ‘24, up slightly from the $165B raised in the period ending in ‘23. It’s a good way to get a sense of who’s going to be writing some of the bigger checks over the coming seasons, so here are a couple highlights. (Note: such a ranking would obv exclude lenders who are hooked up directly w/ a major capital partner, such as Elliott-backed Tyko.)

PGIM again topped the list, raising $13.3B over the period. Rialto, more in the headlines for disputes w/ borrowers in its inherited Signature Bank portfolio, took 3rd place ($8.7B). Madison Realty Capital ($5.1B) came in 8th; as we’ve explored here, their appetite & scope has been steadily growing, most recently w/ NYC’s largest-ever office-resi financing for David Werner/Nathan Berman. BDT & MSD Partners ($4.8B) closed out the top 10; the Gregg Lemkau/Byron Trott co-production landed on our Quiet Kings of Capital list and has also bet big on office-resi, as well as a $1B refi of Boston’s State Street Financial Center for Fortis/Werner. Also want to note Silverstein Properties’ (#15, $4.2B) mention – the credit arm under Shawn Katz has become quite a presence on the scene.

As has been the trend on the broader capital-raising landscape, the biggest players hoovered up a disproportionate share of funds – the top 10 collectively raised 44% of the total haul. New York-based firms were once again dominant, raising over half the capital 🗽 , with LA-based firms pulling in just over a fifth of the capital. As Bobby Bacala would say: To the victor, belongs the spoils.

Vibes Right-Sizing in SF - What About Pricing?

SF is seeing major movements in its CRE market

The data isn’t quite there yet, but the vibes certainly are: San Francisco, that majestic medina on the Bay that saw tremendous capital flight and became a symbol of how not to run a city, is coming back. Under Mayor Daniel Lurie, the sense among CRE players is that SF is once again open for business, compounded by it being the epicenter of the AI boom. Coinbase, after paying $25M to cut bait 4Y ago, has taken 150K sf at Tishman Speyer’s Mission Rock; OpenAI has 1M+ sf in the city; and Nvidia is on the hunt for digs, after CEO Jensen Huang said the city is “thriving again.”

On the I-sales front, big things are trading again – pricing, however, is still being figured out. The latest: Billionaire Greg Flynn (megaplayer in restaurant franchises 🍔 🌮 & a serial bargain CRE hunter ) teamed up w/ DRA Advisors to snap up the distressed $417M note on Market Center, a pair of skyscrapers former owner Paramount Group ( ✈ 🍷 ) wrote down to zero in ‘23. The Flynn/DRA JV paid just $177M to buy the note, per Bloomberg, i.e. under half its face value and penciling out to about $236 / 🦶 “We are buying it at a price that allows us to invest heavily to take it from good to really great,” Flynn told the publication. The towers need a LOT of work – occupancy’s at just 44% – but the pricing gives the partners a decent buffer. On the multi side, players are paying attention to PCCP’s deeply discounted purchase of the Caisse’s stake in a 1,770-unit portfolio in SF/Oakland for $541M, or about $305K/ 🚪

Quickies

This seems WILDLY off: The claim is that PE now owns 1/10 apartments in the US - we’d imagine the def’n of PE is laughably broad here ➕➖ ➗

Brooklyn balabusta: Creditors once again come at Toby Moskovits

Unquotable Quotes

“Do I feel bad about taking money off the tax roles [sic]? Not really I'm just getting some of my money back that you misappropriate anyway.” 🧝♂

- Reap Capital’s David Lilley, on Traveling HFCs as a hedge against Big Bad Government (Syndicators, in general, are masters of saying the quiet part out loud)