Traveling HFCs: Backlash to the Backlash

Jason Post and other developers are crying foul after HB21 abolished Traveling HFCs

This has been The Promote’s pet topic for about a year now, so we missed the drama in recent months as investors were licking their wounds and figuring out their next moves. Traveling HFCs, the Texas property-tax forgiveness loophole that became a refuge for hundreds of millions of dollars worth of distressed multi deals (and good deals that became great), while providing v little new affordable housing, were killed off in May by HB21. The bill was widely seen by CRE players as the nuclear scenario – not only did it close the loophole, but even had a retroactive ⏪ component that sought to unwind existing deals. (If somehow you haven’t been paying attention to this wildly fascinating topic, start here, then here, then here & here, and def. check out the deep dive in the pod here. )

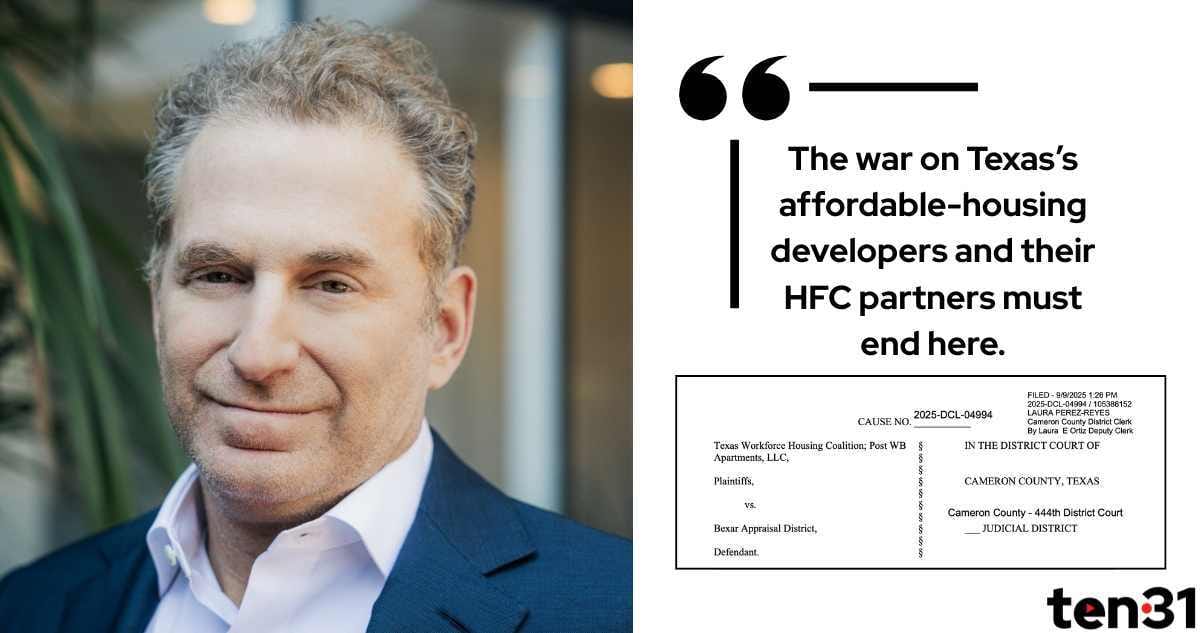

Those most impacted by the nixing of Traveling HFCs had been fundraising for their legal challenge, and now one’s here. 👇

What's On Tap - Sep 10

Tupac Vs. Biggie, CRE Edition 🖖🏾

“It's really like a mix of Lord of War and Blood Diamond.”

“A project like this, it's not like you can walk down the street to your local lender and be like, ‘hello, I would like a $5 billion loan, please.’ You’ve got to form a syndicate.”

This week, it's Tupac vs Biggie, commercial real estate edition: We dive into a deal on each coast that brings together all the things that we think make CRE the greatest show on earth. Rapacious lenders, billion-dollar-dreams, broken capital stacks & creative financing. In New York, we look at the saga of 172 Madison Avenue, Yitzchak Tessler's moonshot condo project that ended in multiple bankruptcies. And in Beverly Hills, we look at the star-studded history of the One Beverly Hills site, and how a motley crew of billionaire Todd Boehly, "Russian James Bond" Vlad Doronin, Cain International’s Jonathan Goldstein and Beverly Hills wheeler-dealer Beny Alagem are putting together a $5B hospitality mecca.

Listen on Spotify here, YouTube here or Apple Podcasts here. A shout-out to our sponsor, Bullpen, a talent shop solely dedicated to the commercial real estate industry. Bullpen can recruit trusted CRE pros at all levels, from analysts to C-suite, and can fill both fractional and full-time positions. Check them out at bullpenre.com to get started.

Traveling HFCs (Cont.)

An affiliate of Post Investment Group, the Beverly Hills-based investor run by Jason Post, has sued the Bexar Appraisal District (county seat: San Antonio), arguing that HB21 violates existing contracts based on the old law, unconstitutionally applies new rules to old deals, and gives municipalities “incredible power” to pull the rug on tax breaks the plaintiffs argue incentivize housing investment in the state.

Post is joined in its action by trade group Texas Workforce Housing Coalition. Here’s the most intriguing argument made in the suit: By including a retroactive component, HB21 undermines faith in the capital markets. I.e. if “a deal’s a deal” no longer applies in the Lone Star State, how can we expect investment to flow there? “If the laws can be changed at any time and applied retroactively to already consummated transactions,” the suit states, “no developer, lender, investor, or HFC could reasonably justify investing in the State.” (The argument against retroactivity is a savvier version of one made by CRE hardo David Lilley on LinkedIn back in May, a diatribe he has since deleted.)

The TWHC is also fighting an attempt by Williamson County to stymie a Traveling HFC originated in Cameron County (a hotbed of such activity). We’ll see if the Texas courts & lawmakers are swayed by such challenges, or if they meet them w/ a “Cry me a Rio Grande.”

“We cannot afford hesitation:” Blau’s Mamdani Mayday

Some of New York’s finest convened an emergency meeting to strategize on the Mamdani threat (Background credit: Dr. Strangelove/Wikimedia Commons)

On Monday evening, Jeff Blau sounded the distress call ☎ : “Sorry for the late notice, but there is no more time for delay, discussion or dithering,” the Related Cos. boss said in an email to NYC’s real estate & business elite seen by the NYT. “We must act decisively to ensure that the next mayor of New York is Andrew Cuomo.” The goal was made clear: Zohran Mamdani must be defeated. (And the subtext: sitting mayor Eric Adams had no shot). Blau asked his crew to gather at the Seagram Building’s Pool Room the next morning; RFR’s Aby Rosen, who owns the joint, co-signed the note. And gather they did, as did Cuomo, the weathered Italian stallion they were now betting all their chips on 🏇

There’s increasing pressure from Wall Street elite on Adams to step aside. Bill Ackman used the General Motors argument, saying that “what is best for NYC — Eric stepping aside — is also what is best for Eric Adams.” There’s also heat from the White House: POTUS 🦅 pointed out that “the mayor is polling badly,” and one of his key guys, developer Steve Witkoff, has been cooking up a plan to get Adams named ambassador to Saudi Arabia. (I do think Adams would rock a thobe w/ panache)

As for Mamdani? Such reports of panicked billionaires conspiring to knock him out play perfectly into his campaign messaging – he has positioned himself as the everyman fighting for the everymen, and seems to be taking delight in the ulcers he’s causing New York’s elite. Meanwhile, some pragmatic builders who presumably were not part of the Pool Room crew have been strategizing how to work w/ a Mamdani administration; MSquared’s Alicia Glen, who was Mayor BDB’s 🐧 housing czar, has been at the center of those efforts, per WSJ, while the all-electric lads at Alloy Development have been praising the fast-track aspect of Mamdani’s housing mandate.

See also: We broke down CRE’s Mamdani fear factor on the pod right after his shock victory in the Dem primary

Angels & Suckers

How hard is this going to be gamed? Thanks largely to Measure ULA (framed by its political champions as a “mansion tax”), the LA Housing Dept. is about to pump $387M into affordable housing projects – $316M of that came from ULA funds. The tax has raised nearly $800M in the 2.5Y since its inception, per the LAT, but lawmakers have been sitting on the money in case of legal challenges. Now, the city’s ready to make it rain, and rather than giving out per-unit funding as it has previously, will fund a % of development costs in the form of gap financing or soft loans - our hunch is that developers will find creative ways to get those costs UP as a result.

(Some good back-forth on the unintended consequences of ULA and the response to that criticism.)

The Ares-Ross Love Affair

Ever since the 🐐 exited his Related Cos. and made Florida his new playground, Steve Ross has been remaking the West Palm Beach skyline to his liking. And no lender has championed him harder than Ares. The mighty fund manager runs $100B+ in CRE AUM, and seems keen to give Ross increasingly bigger slices of it. A $250M refi for Ross’ luxe rental the Laurel comes as Ross is finalizing a $700M construction loan from Ares & Monarch on 2 office buildings within his CityPlace complex downtown. An Ares-affiliated REIT also gave Ross $200M in late ‘24 for another piece of CityPlace. And the ties go way beyond mere sticks & bricks: In Dec., Ross sold a 10% stake in his Miami Dolphins 🐬 to Ares, along w/ a piece of the Hard Rock Stadium and the Miami GP. 🏎

Quickies

Shvo sells Alton Road Miami assemblage to Infinity (Steve Kassin, David Berg) (Also check out our deep dive into Shvo Business here)

Unquotable Quotes

“This time he’s dealing with an Israeli guy who will teach him a lesson.”

- Gadi Ben-Hamo, accusing distressed debt investor Maverick of foul play at a Chetrit deal