Mayweather’s Truthful Hyperbole

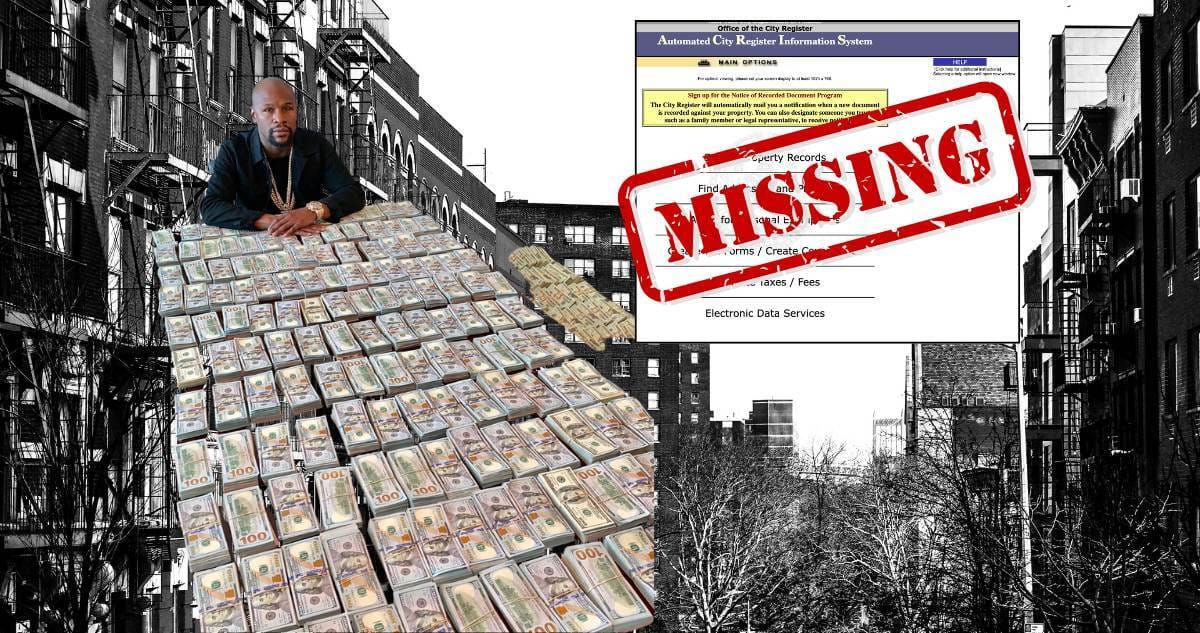

Floyd Mayweather said he made a $400M+ deal. But did he really?

"I'm the best at talking trash. I'm also the best at going out there and backing it up." - Floyd Mayweather Jr.

Generally, when an investor goes into contract to buy something at a certain price, the assumption is that they are taking it off the seller’s hands at that price. I know how comically trite that sounds as I write it, but bear with me – promise I’m not trying to rope-a-dope you.

In October, undefeated boxing legend Floyd Mayweather Jr. announced his splashiest bit of business since he hung up the gloves: A $402M deal to purchase a 60+ building Upper Manhattan-centric multifamily portfolio. “This purchase holds deep emotional significance for me and my family,” Mayweather said in a statement at the time to TRD, which reported that a chunk of the 1K-unit package had already closed.

Fast forward 6 months, and no closings have been recorded. Moreover, that $400M+ figure might have been more of pre-fight hype talk than reality.

What's on tap - Apr 2

Pod Drop: CrowdStreet, CMBS, LifeCos, Nepo 👶

“It’d be like if Patek Philippe set up shop on a cart on Canal Street, walked away for 2 hours, and then went, ‘my God, we got robbed!’” ⌚

“Access to capital that is not fund-based – that's really where everyone is trying to go at this megafund level.” 🚰

In the Elie Schwartz record CRE crowdfunding scam, is CrowdStreet victim, villain, or a bit of both? Why are lifecos stepping up to fund bigger & bigger deals, and what’s Apollo got to do w/ it. And, if you ran a massive NYC office REIT, what would your go-to nepotism move be? Episode 4 of The Promote Podcast riffs on all this, and more - we also have a Val Kilmer (RIP legend) Heat reference. Listen on Spotify here or Apple Podcasts here. If you’re interested in advertising, hit us up here. And please, smash that SUBSCRIBE 🖋️ button and leave us a rating ⭐️⭐️⭐️⭐️⭐️ – we need the ten31 community to give this love to help it get discovered 🙏

Mayweather (Cont.)

Per a spicy new report from Business Insider, “a deal to sell the properties outright to Mayweather does not seem imminent.” The NYC Housing Partnership, a nonprofit whose partnership interest in the lion’s share of the portfolio allows it to qualify for tax breaks, told the publication that it has not been alerted of any pending sale. "Generally, the partnership would be advised of the transfer and would be party to the transfer,” it said. “That has not occurred." What seems to have happened here instead, per BI, is that Mayweather bought a small minority stake in the portfolio from owner Black Spruce Management (Josh Gotlib), and has an option to upsize his stake or take full control.

Gotlib’s firm gave the following cryptic statement to BI: “To date, Mayweather has performed on all of his obligations." 🤷♂ After the BI story was published, TRD followed up w/ its own postgame piece, confirming that only a minority-stake sale had transpired. Mayweather’s reps clarified that when the boxer declared that he didn’t have partners on the deal, what he meant was that he used his own money to fund his stake purchase. He didn’t take full control of the portfolio, because Black Spruce is in the midst of scoring 2 govt. boosts – the Article XI tax cut and a Sec. 610 subsidy – on the portfolio, and shuffling ownership while all that is happening could complicate matters.

The Promote’s take: This, at least for now, is far from an actual $400M+ deal – the transaction could hypothetically have been as little as $10M, let’s say. That is not normally something that would warrant a $402M deal tombstone (which, in a further twist, has debt guy Morris Betesh’s Arrow as the broker), but when CRE mixes w/ showbiz, anything can happen. “Respect the hustle,” Mayweather wrote when he shared the TRD article Tuesday, “instead of trying to dissect it.” 🥊

Crunching the Impact of LA’s “Mansion Tax”

Measure ULA, LA’s so-called “mansion tax,” one of the biggest pieces of bait-and-switch legislation the city’s seen in decades, was instituted in Q2 ‘23 w/ the stated goal of having luxe home purchases subsidize low-income renters. In reality, though, the policy hobbled the overall CRE market 🩼 , brought in far less revenue than it was projected to, and has made new housing much tougher to build, according to a devastating new study by UCLA’s Lewis Center.

Looking at over 300K LA County deals between ‘20-24, the authors found that Measure ULA “led to a 30-50% decrease in the number of commercial, industrial and multifamily transactions.” Sales of $5M+ are responsible for 40% of LA’s property tax growth, study co-author Mott Smith wrote. “Cutting those sales in half cuts growth proportionally.” And then, the kicker: Smith estimates that in a decade & change, the “annual property tax revenue suppressed by ULA could actually exceed the annual ULA funds raised.” But of course, by then, Nithya Raman and her crew of crusaders would have moved on to something else. They treat LA housing policy like rental cars.

EB-5 Investors Win Key Battle at DTLA Megaproject

EB-5 investors will be first in line to be repaid at Oceanwide Plaza

Some comfort for EB-5 investors who coughed up funds to build what has turned into DTLA’s biggest boondoggle: A judge ruled that they will be in first position to collect payment if (and it’s a big IF) the 3-tower project is sold, per Bisnow. The EB-5 investor group known as LA Downtown Investment held a $200M+ lien on the property and had been battling w/ contractors (Lendlease, Webcor) – who say they are owed $215M – over who gets paid back first. Whether a sale will happen soon though is up in the air: there was reportedly a $500M stalking-horse bidder back in the summer, but no word of where that ended up, and even the broker shopping the deal is circumspect about when a deal could happen – “At this point, it’s just kind of useless to estimate,” said Colliers’ Mark Tarczynski. “I’ve got to tell you, putting together a billion-five in today’s environment is not exactly easy.” Brokers are hardwired to be Ned Flanders-esque optimistic, so we know there’s an issue here.

Embattled Chinese developer Oceanwide Holdings reportedly has already pumped $1.2B into construction and claims the project (500+ condos, 184- 🔑 hotel, open-air mall) is nearly 2/3 complete – not sure anyone will trust their math tho. 🤷♀

The Rikers Redemption: HFZ Kingpin Out on Bail

Nir Meir is out on bail after a year & change on Rikers

Nir Meir, the former HFZ Capital principal who allegedly orchestrated an $86M fraud scheme that rocked the Manhattan development scene, is finally out on bail. After spending just over a year detained on Rikers, Meir was released on a $1M fully secured bail bond, per TRD, and will wear 2 ankle monitors. He will live somewhere in NYC, and will only be allowed out of his residence to go to court and see his attorney. How Meir coughed up the funds for the bail and his NYC digs remains TBD – remember that last year he claimed to have just $50 to his name.

Meanwhile, the DA recently agreed to prosecute Omnibuild (and its CEO John Mingione), the contractor on HFZ’s XI (now reborn as Witkoff/Blavatnik’s One High Line), separately from Meir, which is what Omnibuild had been pushing for. “We were the first people to warn the D.A.’s office about Nir’s fraudulent acts,” a rep for Omnibuild told TRD, “and were victims of his theft.”

Quickies

Seattle office titan Selig lays off 86 employees as properties enter receiver 🚢 (more on Selig here)

Juicy Meridian-brokered deal here: Pearlstone lands $155M construction loan from Benefit St. for Austin condo project 🧃

Unquotable Quotes

“The golden goose was slaughtered long ago. All that’s left is foie gras and down pillows.” 🦢 ⚔

- Timber Equities’ Mitch Perle, on how NYC neglects its biggest tax base – landlords