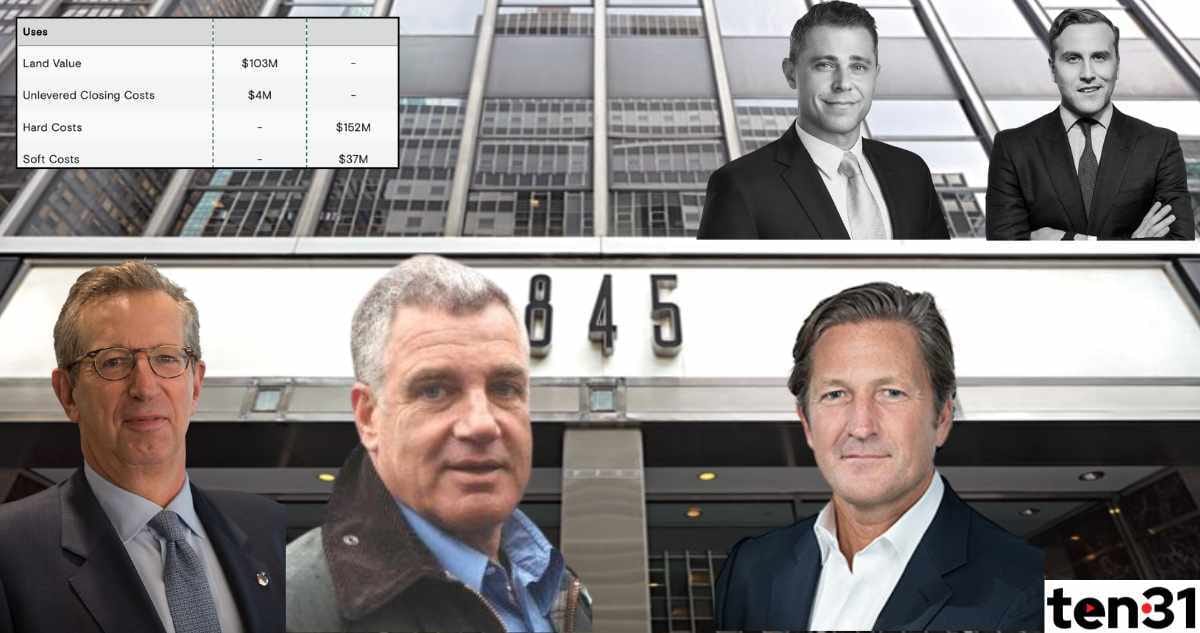

On Wednesday, Promote Insiders enjoyed a rare peek at the u/w deets on the financing of a major office-resi play, the Rudin/Idan Ofer conversion of 845 Third Ave. We walked through both the OM on the debt quest AND the lender model, and there are tons of takeaways for both money-hungry sponsors and anxious-to-deploy lenders. If this and other deep-in-the-weeds breakdowns sound like your jam, you can check out premium on a 2-week free trial and read it here. Information is oxygen, so sign up now and breathe easy 🫁

What's on Tap - Dec. 1

If You Raise Retail Capital, Listen to This

The lads over at the Best Ever CRE Show (sus name, but impressive longevity) had me on to talk about hacking commercial real estate media, the power of syndicator storytelling, and how big institutional players making a mad rush for retail money is bound to create some imposing competition. Richard McGirr was a curious and enthusiastic host, and I enjoyed the conversation, which focused on a tactical playbook for OPMers. Listen on Apple here, Spotify here, or watch on YouTube here.

Satmar Pezzonovante ™ on Infamous Mamdani Nod

Rabbi Moshe Indig explains his heavily criticized endorsement of Zohran Mamdani.

I’ve just read one of the most extraordinary political interviews. In Nov., when the NYC mayoral race was still a race, a prominent rabbi from Brooklyn’s Satmar community (major machers in NY multifamily) went off-piste and endorsed Zohran Mamdani. Rabbi Moishe Indig’s decision was deeply divisive: Some community members saw it as a betrayal of their values, and questioned how the hell Indig could commune w/ a candidate who seemed like their worst nightmare. For Indig, however, it was simply textbook good politics.

“What do you think politics is? You think I’m his mechutan? I’m his brother? That I love him? This is absolutely transactional,” Indig told Haredi-focused pub Mishpacha. He described the backlash he got as “taking missiles, not just bullets,” and said that putting his considerable heft behind Mamdani ( now mayor-elect) served his mission of serving the Satmar community. And then he dropped this absolute banger:

“I’m here to establish the access to the halls of power so critically needed by our many communities. This was the time and address at which to do it — not after the election, coming like an esrog after Succos 🍋”

He didn’t mince words about Andrew Cuomo’s flaccid run, saying that he “went MIA” right after receiving the community’s endorsement in the primary. “He went completely back to being Mr. Cuomo, and he hadn’t even won the election yet.” He then got specific on one of Mamdani’s most feared proposals: freezing the rent 🥶 for 1M+ rent-stabilized units. “The Satmar Rebbe [Aron Teitelbaum] is doing exactly that in Kiryas Yoel — he has capped the rent that people can charge and actually driven down rent and sale prices on homes in the town,” Indig said. “I see young families in Williamsburg choking under impossible rents; I understand the need to get it under control in New York City.” And for landlords & developers terrified of a Mamdani administration, he had a message: You’re a big part of why he won.

“For years, major builders — a large percentage of them Jewish — have been constructing high-rise luxury apartment buildings [across Brooklyn neighborhoods], Indig said. “Families are priced out of these developments, and they are populated with hundreds of thousands of young, single, liberal hipsters — Mamdani voters.”

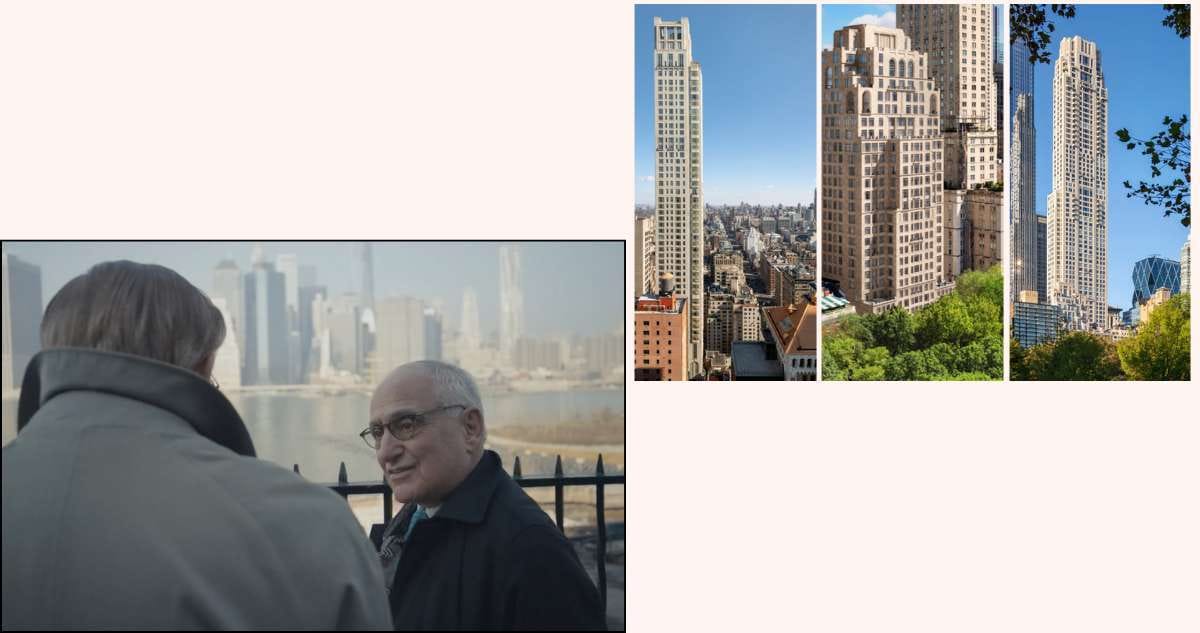

WATCH: The Man Who Broke CRE Finance

How did a former Cutco knife salesman from Jersey became the nitrous oxide of the CMBS market, funding what felt like half the skyline at his pomp? And how did that same guy later reinvent himself as Mr. Fix-It of pulverized capstacks? Our snapshot of Robert “Large Loan” Verrone is now live on YouTube. We’ll be doing more of these videos on projects & players across the country, so write us w/ suggestions.

RealtyMogul’s Whimpery Reboot

It’s still astonishing to us that RealtyMogul – the startup that along w/ Fundrise was emblematic of the rise of CRE crowdfunding and got tons of fawning press – rode off into the sunset earlier this month, and its fire-sale takeover by Wideman Company got near-zero coverage. The startup, founded by Jilliene Helman, raised $45M in VC and claims to have put $1.2B of equity into CRE deals. And now it’s gone, Moe Greene style. The Widemans are wasting no time putting the carcass to work, though: they’re marketing 2 FedEx-anchored industrial properties in KY and TN through the platform (min. investment $35K), according to a Sunday blast reviewed by The Promote. As we’ve talked about on the pod a bunch, distribution is half the battle, esp. w/ 401 (k) money now up for grabs, and though RealtyMogul was a deeply flawed business, that distro can be v valuable for those who know how to milk it. 🍼

Bettin’ on Betesh: Green Pine Lads Sign On

Of all the Meridian Capital rainmakers who found their way out of the 1 BPP cauldron, Morris Betesh looks to have had the hottest start. Betesh’s Arrow Real Estate Advisors has been on a deal flurry, taking on meatier assignments while also vacuuming up more Meridian alum (Schmuckler etc.) The latest adds are notable: Ronnie Levine & Seth Grossman, 2/3 of new CRE investment shop Green Pine, are signing on as “senior advisors,” per CO. What that really means, per sources: Grossman will originate deals for Arrow, while Levine will run point on them. Missing from the mix is Green Pine’s 3rd principal, former Meridian prez Yoni Goodman. Word is that Goodman has a noncompete that prevents him from doing any biz w/ a Meridian rival, which Arrow decidedly is. Should be clear that Levine, Grossman and Goodman continue to run Green Pine, which per sources has put out ≈ $100M in equity x the capstack in national deals. Green Pine just doesn’t feel like a final chapter, though – we’d expect more news to drop in the coming months🎍

Quickies

LOLOLOL on the timing here: Larry Ellison bought Shari Redstone’s media colossus, and ALSO bought 2 Pierre pads from her for $24M. Wonder if this is an M&A sweetener/cute tax thing/ bit o’ both

ICYMI: The influencer, the refi, & the rapid-fire default 👨🦲 💪 🤷♂

Glad we didn’t cover this when we heard, b/c Engquist’s telling is thorough & fun: Riguardi nepo 👶 clings onto starving-artist rent at Soho loft

Happy Birthday to soul brother + soul of The Promote Pod: Will Krasne

Limestone Jesus Tops Out

Robert AM Stern has died at 86. His limestone aesthetic came to dominate the highest end of the luxe market

People have a wide variety of fetishes: money, power, Munger, feet. There was a boy from Brooklyn, however, who fetishized a rock. His obsession with that rock was so all-encompassing and so passionately expressed at the highest levels of architecture that eventually, the toniest of buyers – and by extension real estate developers – fetishized it too. Read our Robert A.M. Stern obit – written purely for CRE insiders – here.

Unquotable Quotes

“I can’t comprehend why they chose to do this.” 🤯

- NYC multi investor Peter Hungerford, flabbergasted by Rialto’s move to foreclose on $173M of his NPLs