Feds Investigate GVA’s Stalcup for Fraud

The SEC is looking into dealings by Alan Stalcup’s GVA

(Editor’s Note: Read our extended interview with Alan Stalcup from 1/18, where he addresses all of it: the lawsuits, the PGs, even the SEC investigation chatter)

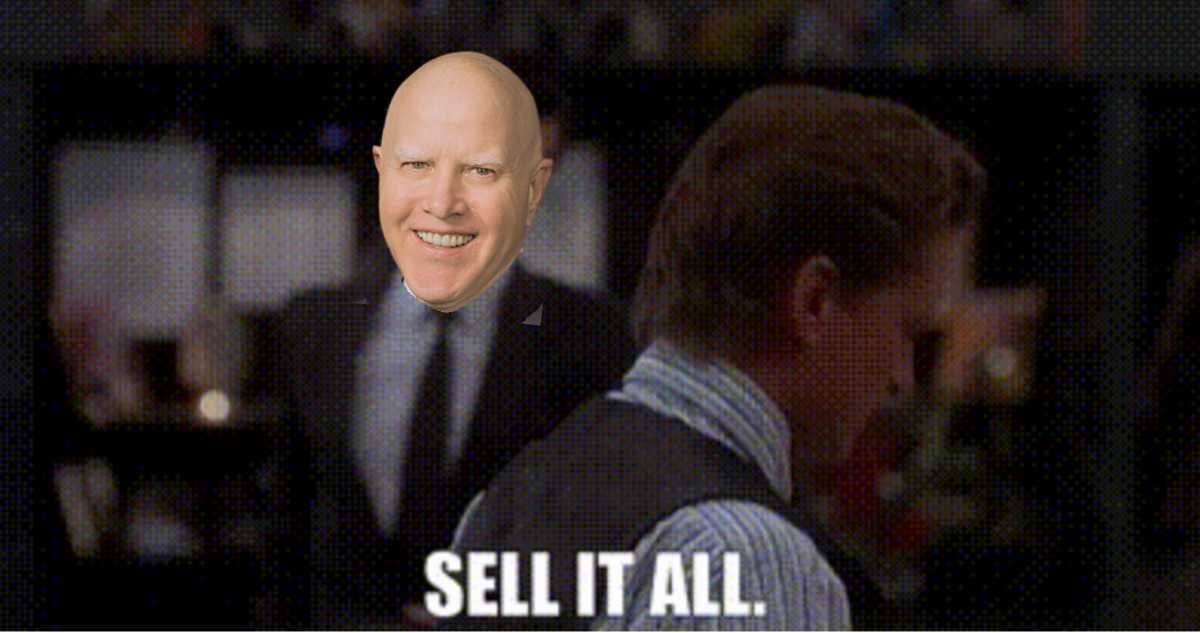

GVA’s Alan Stalcup, one of the most prominent faces of the Sunbelt multifamily syndicator boom-and-bust, is the subject of a federal fraud investigation.

Stalcup has been accused of a litany of wrongdoings by both his LPs and his lenders, everything from cooking the books by packaging bad debts as assets to concealing a conflagration 🎆 from the debt fund that financed his deal. But all those accusations were part of lawsuits brought by private individuals and firms – this looks to be the first time any SEC involvement has come to light.

Jackson Walker, a law firm representing a family suing GVA over fraud allegations, was served a subpoena by the SEC demanding certain docs and a transcript of a deposition w/ Stalcup, per the Austin American Statesman. Stalcup told the paper that he welcomes the investigation into “defamatory fictions.”

At his pomp, Stalcup controlled 30K+ units, amassing them at a breakneck pace through a series of big acquisitions. An ungodly chunk of that portfolio later experienced distress (live by the 🛟-rate, die by the 🛟-rate), and opportunistic rivals (incl. Swapnil Agarwal’s Nitya & Scott Everett’s S2) have since snapped up much of it. Stalcup’s creditors and investors continue to ratchet up the legal heat, and in their filings we learn of GVA’s penchant for an array of creative fees. 👇

What's on Tap - Jan. 9

🎙 Windy City Tailwinds & Stadium Arcadium

“These things take more than a village, they take almost a nation-state. And so you need the nation-state-type guys to get it done.”

“Imagine being the founder of CIM and being the less successful brother.”

This week on the pod, we get Malörted in the Windy City – Chicago is now top of mind for national multifamily players. We break down 2 significant deals: LaTerra’s monster AIMCO portfolio buy and S2’s debut. We then slip into our jerseys and look at the arcane world of stadium development – and all the freebies and surrounding action that comes with it. Finally, we schlep the streets of Brooklyn, where Carlyle & Greenbrook have pulled off the massive Freddie refi of their walk-up empire. A shout-out to our sponsor LoanBoss, the industry-leading debt management software. Featuring one-click covenant testing, instant cash flow forecasting, and our favorite nerdy delight: Live forward curves! Check them out at loanboss.com

Listen on Spotify here, YouTube here or Apple Podcasts here. Brands: To get in front of our obsessed audience of CRE insiders, reach out here.

Glitch in the Morse Code

“I refuse to join any club that would have me as a member.” - Groucho Marx

Tyler Morse’s MCR Hotels, which was leading a push to take Soho House private at a $2.7B valuation, disclosed to its partners that it’d be unable to fully fund its $200M commitment, according to a filing by the members-only club giant Thursday. This revelation set off a scramble among the investor group to fund the gap, per WSJ – options include existing shareholder Goldman Sachs Asset Management rolling over add’l shares, or other investors coming in. The club’s controlling shareholder is Yucaipa’s Ron Burkle, who’s set to roll over his stake. Also in the mix is actor/investor Ashton Kutcher, as well as Apollo, which is set to kick in $800M+ of debt + equity. Shareholders are still expected to vote in favor of the take-private Friday.

We talked on the pod recently about how Morse, who had the “Barry’s Guy” job at Starwood, built MCR on select-service bets – these are unglamorous (“fight off the govt. contractors down there at 6 a.m. for the good eggs”) but cash 🐮 s. Lately though, he’s been drawn to more exotic 🐆 bets such as the TWA Hotel ✈ and Soho House, which are more fun to talk about on panels but trickier to ✏

On Wednesday, subscribers to The Promote Insider learned of agency lender Lument’s buyer hunt, as well as recent signs that OZK is switching things up. You can sign up for Insider and read it here.

Agency Fraud Fallout: Walker Probes, JLL Owed

Some behind-the-scenes drama at Walker & Dunlop, which revealed in a Nov. earnings presentation that it has exposure to “specific incidences of mortgage fraud” and is in negotiations w/ Freddie on the indemnification of 2 impacted portfolios totaling $100M. It has earmarked $20M of its own capital as collateral. (Freddie & Fannie have buyback provisions in certain instances in which fraud is discovered.) The firm also hired outside counsel to look into sus transactions, per TRD, and has put some originators on leave during the investigation. The Promote’s since learned a couple of those names: Jared Sobel, based in New York; and Jeremy Nussbaum, based in Englewood Cliffs, NJ. Both their company pages were live earlier this week; they are now off the site – archives here & here. Walker didn’t respond to requests for comment.

One of Walker’s repeat borrowers is Mordechai Weiss, who’s been a thorn in Fannie’s side; the agency moved to foreclose on the tallest apartment building in Louisville after Weiss allegedly stopped making payments just 2 mos after receiving the loan. Weiss is also the target of the sweeping DoJ/FHFA mortgage-fraud probe, per TRD. He was also at the center of an allegedly fugazi Houston apt deal, w/ Berkadia claiming it lost $24M+ over the inflated purchase price 🎈that led to a bigger mortgage. This, of course, is the classic Drillman 🚬 / Puretz/Schulman/Silber playbook. And speaking of Silber: the Pied Piper of Monsey is halfway home already after just months in the can. A party pooper tho: He and Schulman were just ordered to pay $22M in restitution to JLL over a soured Fannie deal.

In general, agency lenders have been focused on moving away from using external brokers and instead building those capabilities in-house, which has changed up the battlefield for the talent wars.

O Brother, Where Art Thou?

Quick update on NYC’s most-scrutinized bankruptcy sale: All week we’ve been looking at Zohar Levy, the Summit Properties chief who’s set to take over the monster Pinnacle (Joel Wiener) RS portfolio via a stalking-horse bid. We looked at Levy’s sprawling portfolio Monday. Then, on Wed., Promote Insiders learned of his involvement w/ David Tennenbaum’s Denali Management. That connection showed Levy’s prior involvement in NYC RS, and Bisnow also reported on a further wrinkle: several deeds on properties that Summit says it owns are signed by Jonathan Wiener - Jonathan Wiener, of RS landlord Chestnut Holdings, is Joel Wiener’s brother. 👏 (Jonathan Wiener and Tennenbaum have previously been named as co-defendants in an unrelated employee dispute.)

A rep for Chestnut told the outlet that it “has neither any business connection to Pinnacle nor any connection whatsoever to any Summit bid for Pinnacle properties.” (OK.) This is all coming to light as the city moves to intervene in the sale, though a judge rejected its request for a 30-day stay. Flagstar stock jumped on the news of the ruling - TBD whether they’ll opt to fund the acquisition for Summit.

Quickies

The Donald 🐐: Gibson Dunn renews 362K sf at MetLife Building

Saks may file for bankruptcy as soon as Sunday (what else might Big Ben snap up?)

The controversial Measure ULA - billed as the “mansion tax” – has now raised over $1B. But weigh that against its hobbling of the CRE market

Google founder Larry Page drops $173M on Miami estates (if ultra-luxury is of interest, def listen to our Odd Lots on the segment)

Unquotable Quotes

“You either get old and you benefit from the years, or you get old and die. And I ain’t dying.” 🪬

- Retail restructuring kingpin Ivan Friedman, on having seen it all before.

The Promote will be at CREFC: Please invite us to all your stuff. We’re a good hang and happy to keep things off-record. 🌴 🦈

Stalcup - Conclusion (Insiders-Only) 🔒

Continue reading with The Promote Insider

Unlock this story and all premium content. Start your free trial.

BECOME AN INSIDERWhat you get:

- Exclusive content: Weekly deep dives, deal memos, insider breakdowns, and interviews

- Expert columns: Analysis from the investment and capital markets trenches

- Bonus podcast episodes: emergency pods, Q/As, deal walkthroughs