Age of Empires: JPMorgan’s NYC Campus Play

JPMorgan is among the advanced bidders for PIA’s Roosevelt Hotel

“This company is going to set our own standards and do it our own way.” - Jamie Dimon

Jamie Dimon, the JPMorgan boss and patron saint of New York’s office landlords, may not be done with his empire-building in Midtown.

The mighty bank is among the advanced suitors for the PIA’s ✈ Roosevelt Hotel, The Promote has learned, having submitted a proposal to ground lease the site for 99Y. A deal, if consummated, could result in one of the most formidable corporate campuses in recent New York history, giving JPM control of 7M sf (depending on how you slice it) of prime Midtown space.

What's On Tap - July 18

Powered by: Vesto

Managing a lot of bank accounts? Most CRE players find tracking cash across banks and project LLCs to be a huge pain… Enter Vesto. With real-time balances, transactions, and cash flow monitoring, Vesto has helped over 100 CRE firms connect and control all their business bank accounts from a single, intuitive dashboard. Check out how Vesto can help you here.

JPM (Cont.)

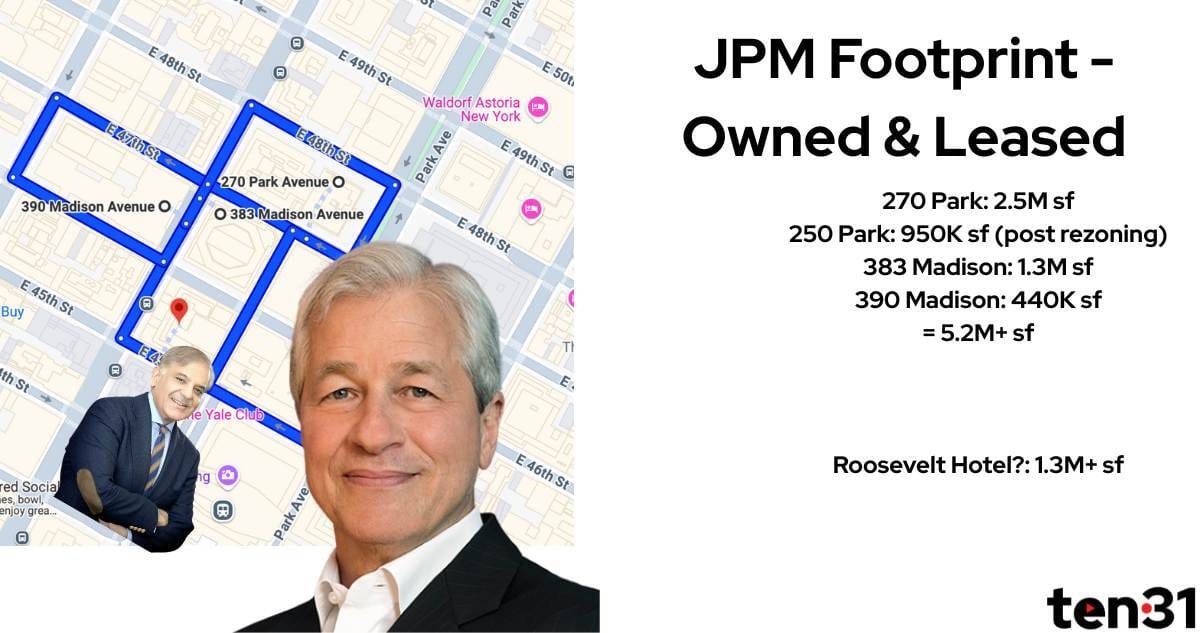

JPM’s June proposal, which hasn’t been previously reported, is structured as a long-term ground lease to avoid Pakistani govt.-run PIA facing a hefty tax bill. There have been various estimates of how much space a redevelopment would allow, ranging from 1.3M sf to 1.5M+ sf w/ air rights, transit improvement bonuses, etc. Whatever number you go w/, here’s what JPM currently has

If you add the Roosevelt (45 E 45th St) to the mix, you’re looking at ≈ 7M sf all within a short walk. (Compare that to Google’s 3M+ sf on the West Side.) This is Dimon seriously putting his money where his mouth is – the banker mandated a 5x/week RTO for JPM employees in Jan., and went on a HoF tirade against remote work in Feb.

NYC Mayor Eric Adams said in Feb. that the city would no longer use the Roosevelt to shelter migrants, putting the block-long property at the center of New York’s development zeitgeist. Soon after, every name worth mentioning was thrown into the pot, from SL Green to Tishman Speyer to Related & Vornado; it’s unclear how far those “informal conversations of interest” progressed, though sources said SL Green has submitted a proposal. In April, Bloomberg reported on a proposal by a relative unknown, Shahal Khan’s Burkhan World Investments (?) to JV a 1.3M sf redevelopment w/ PIA.

The 1K+- 🔑 asset is currently managed by Aimbridge Hospitality, but sources said that Highgate, the hospitality investor founded by the Brothers Khimji, is slated to step in soon. There’s a union hurdle to navigate here: Any buyer would have to pay a hefty termination fee to the Hotel Trades Council (Local 6) to operate the property in a different capacity, per the union’s contract w/ PIA.

A JLL team led by Peter Riguardi is representing Pakistan; reps for JLL didn’t respond to requests for comment. The Pakistanis came into the hotel in the late 70s, leasing it (w/ an option to buy) from the mighty Milstein family. In partnership w/ Saudi prince Faisal ibn Khalid, they exercised that option in ‘00, paying just $36.5M, but not before a bruising court battle w/ the Milsteins. Pakistan has made a series of stop-and-start attempts to unload the asset, which is one of its most prominent foreign holdings – if you’re even a casual observer of the full-contact sport that is Pakistani politics, that will not come as a surprise. Don’t expect a quick resolution of this situation, which given the govt. involvement is likely to be a bureaucratic clusterfuck.

But if it does indeed go JPM’s way, it would be a campus for the ages. ✈

Banyan Now Controls Schwartz’s Patient Zero

After stepping into the note, Banyan has taken control of the Atlanta Financial Center

Banyan Street Capital (Rudy Touzet) has taken full control of the Atlanta Financial Center, the most likely outcome after the firm struck a deal to buy the debt in May. Banyan now controls the 915K sf Buckhead property outright, per the AJC, which did not disclose a price – but you can kinda back into it. Banyan agreed to buy the NPL for less than half its $122.5M face value, i.e. less than $70/ 🦶. Once Banyan controlled the debt, long-suffering Sumitomo – which along w/ CrowdStreet’s retail investors was one of the key sacrificial lambs in the Elie Schwartz scam – likely had no interest in fighting on. Given how quickly this has moved, a foreclosure seems improbable, which leaves us w/ a deed-in-lieu. Our bet is there was a nominal payment made to Sumitomo in the form of a settlement 🤝 , and that’s all she wrote.

Resurfacing something we wrote in May, when REA broke the news of the note sale: Good deals can be found in the circadian rhythms of the market. Great deals may require a little extra: a macro shock, or perhaps a dramatic change in fortunes. Stepping in after massive fraud has occurred is one way to get there. 🪶

Meanwhile: Nightingale’s fmr. South Beach joint, another casualty of the Schwartz scam, hits the market via lender

Starwood Snaps Up Brookfield’s NNN Machine

We gotta get those AUM Gobbling ™ hoodies printed already… Starwood is buying Brookfield’s NNN machine Fundamental Income Properties for $2.2B, giving Barry Sternlicht’s joint control of 12M sf across 467 properties. Sternlicht described the deal as the “next evolution, but not the last” 🦧 🦍 of the Starwood platform. It’s part of a wave of big-ticket platform M&A we’re seeing across CRE, and it was the topic of our recent explainer video 👇 and podcast episode.

Warren Asks How the Private Credit Quiche is Made 🥧

Sen. Elizabeth Warren is pushing for more scrutiny of Wall Street’s obsession with private credit, which is an ever-growing piece of the CRE capstack. Warren hit the ratings agencies (S&P Global, Moody’s, Fitch) w/ letters last week, per WSJ, asking for deets on how they evaluate the riskiness of the instruments. The rating for such instruments is a bit of a Wild West at the moment; one upstart firm, Egan-Jones, has grabbed market share through a flurry of optimistic ratings, but has been iced out by major sponsors such as Apollo, BlackRock & Carlyle.

Warren also asked Treasury Secretary Scott Bessent to provide a sense of just how big the private-credit market is, and its potential impact on the financial stability of the US overall. In May, new SEC chair Paul Atkins hinted that the agency may begin allowing fund managers to sell private-investment products to a bigger pool of retail investors, incl. unaccredited ones.

Also see: Insurance Juicing Private Credit Boom

Quickies

WTH is happening @ Greystone? LA-based dealmaker Eliav Dan also out, follows recent exit of Fannie rainmaker Dan Sacks

Other half of shuttered Nussbaum Lowinger tells (part of) his side of the tale (note that Lowinger now works for Avery Eisenreich’s FO) 🎷

Hackman, Affinius snag $280M refi on NYC’s Silvercup Studios (lender remains Apollo/DB) 🎬

EB-5 investors say Netflix founder is on the hook for $76M - we broke down Hastings’ grand private powder plans here & on a recent pod ⛷

Unquotable Quotes

"We've not seen a single instance of that being an issue or I'll even say a discussion point."

- SLG’s Marc Holliday, pooh-pooing the Mamdani fear factor in the New York market