Comps Be Damned: Find the 1/1 Buyer

Sotheby’s former HQ has sold to Weill Cornell for $510M - that’s the news. But there’s also the backstory

Such a great tale of the tape here for the UES building that used to be Sotheby’s auction house HQ. In ‘03, bruised by a price-fixing scandal, Sotheby’s sold the 1334 York Ave property (then 470K, now 500K+ sf b/c loss factor) in a sale-leaseback deal for $175M, or about $370 / 🦶. The buyer was RFR, which realized a handsome profit in ‘09 when it sold the building back to Sotheby’s for $370M ($700s/ 🦶) - our favorite detail is that this sale came w/ “certain terms for future sales of work at Sotheby’s auctions,” for RFR principals – RFR co-founder Aby Rosen is a prolific art collector 🖼

The years roll by. In ‘19, telecom billionaire Patrick Drahi (who sees CRE as a core asset for the firm) swooped in to buy Sotheby’s in a $2.7B take-private. The following year, Sotheby’s refi’d the HQ property w/ a $483M floater from Barclays. In ‘23, Sotheby’s snapped up the Breuer building from the Whitney for ≈ $100M. Envisioning the Breuer as its new HQ, it had to figure out a plan for its York Ave digs. So along came Weill Cornell Medicine, which leased 200K sf at the property as part of an expansion of its campus. Sotheby’s was repped on that deal by CBRE leasing 🐐 Mary Ann Tighe (hold that thought), and the dean of Weill Cornell made clear how clutch the location was for the school, noting that it’s “only steps from where our doctors see patients.”

Which brings us to the present day 👇

What's on Tap - Oct. 3

WATCH: The Rise, Rise, Rise of LifeCo Lending

If you’re playing CRE lender bingo in the institutional market today, you’ve gotta have Athene at least 3x on your card. But how did we get here? How did Apollo, KKR, BX and their ilk reimagine life insurance as NOS for their private-credit bets? Our latest YouTube explainer @ten31tv dives into the topic – premiums became seed capital for PE funds, funds are leveraged to create debt-origination platforms, the debt flows back into insurance cos, and on and on we go. Check it out and please share with others who might be interested – this is one of the more consequential trends in CRE finance today.

Also check out our other recent YT features:

1) Inside a Manhattan real estate debacle

2) The insane backstory of One Beverly Hills

Sotheby’s (Cont.)

Weill Cornell has bought the building outright from Sotheby’s for the king’s ransom of $510M, or north of $1K / 🦶, per Bloomberg. Tighe stayed in the mix here, a rare sales deal for her, along w/ colleague (& friend of the pod) Doug Middleton. JLL repped Weill Cornell, which said the deal gives them ownership for “materially the same net cost as leasing.”

There’s enough here to remind us of RFR’s 🐰 -out-of-a-hat deal in Lenox Hill, when it first leased a good chunk of 980 Madison to Bloomberg Philanthropies in ‘23, and then sold the 118K sf building outright to Mayor Mike a year later for the astonishing price of $560M - $4,700 / 🦶 as built or $2,700/ 🦶 when accounting for air rights. Or consider Jeff Sutton’s $1.8B masterclass on Fifth Ave w/ Kering & Prada, which blended at $6K/ 🦶 🫡 .

The mantra: A good seller thinks in comps. A great seller finds the 1/1 buyer for whom comps are irrelevant.

Capstack Chronicles: Diving Deep Into OKO’s One River (Promote Insider Teaser)

OKO and Cain’s One River never really got off the ground. The numbers don’t quite justify it.

Editor’s Note: What you’re about to read is a snippet of a forensic dive into one of South Florida’s most interesting stalled projects, OKO Group and Cain International’s One River in Ft. Lauderdale. It comes to us c/o Ed Bond, a CRE investor who we’re thrilled to have as part of our stable of expert contributors for The Promote’s premium tier. I’ll link to the full dive below as well. Consider upgrading to get regular drops like these – founding memberships now live at $240/Y - HS

By Edward Bond

Feasibility

Ultimately, everything discussed thus far would be manageable if the project were feasible. Recall the Uses section:

OKO is projecting the total cost to be $670,000 per unit! Here are the sale comps provided in the Investor Update:

Even the ‘21-’22 multifamily boom didn’t touch One River’s cost to build and they still don’t have firm construction pricing.

OKO is underwriting to $3.60/foot in rent. Though that seems a tall order, here’s an aggressive pro forma:

This is why construction hasn’t commenced. The numbers do not work. Even under a very aggressive scenario, it’s unlikely to be profitable

Now, let’s look at realistic numbers 👇

International Dispatch: Mumbai’s Billionaires’ Row

Worli Sea Face has become India’s billionaire bunker - moguls be droppin’ NYC prices

Mumbai is, to quote the author Suketu Mehta, a “maximum city,” boasting a collision of old/new money, power, celebrity and real estate you can otherwise only find in Manhattan. And its enclaves of the ultra-rich have much in common with ours: Take Worli Sea Face, a waterfront district that has skyrocketed in value after the construction of a coastal road. India’s tycoons are dropping Central Park type money for pads on the former industrial stretch, per a terrific new FT article, and developers are reaping the rewards. One project in particular, Naman Xana, feels v Barnettian: Shree Naman Group razed a ramshackle bungalow on the site to build a 500-foot tower w/ just 16 units, and 4 of India’s richest families have snapped up at least 7 of them - one pharma tycoon paid ≈ $75M for a duplex 🤯 Other moguls (banking billionaire Uday Kotak, alpha solicitor Cyril Shroff) are redeveloping their holdings on the block to create captain-of-the-universe abodes that would make Ken Griffin insecure. Meanwhile, conglomerates such as Mukesh Ambani’s Reliance Group are spending big to develop the surrounding area.

Shree Naman chair Jayesh Shah dropped a banger about top-tier buyers that would surely have his US contemporaries nodding along: “The rich want a good community,” he said. “The ultra-rich only want exclusivity and privacy.”

PS: If you’re fascinated by the broader pricing disconnect between the ultra-luxury sector & the rest of the market, I reckon you’ll enjoy our breakdown on Odd Lots

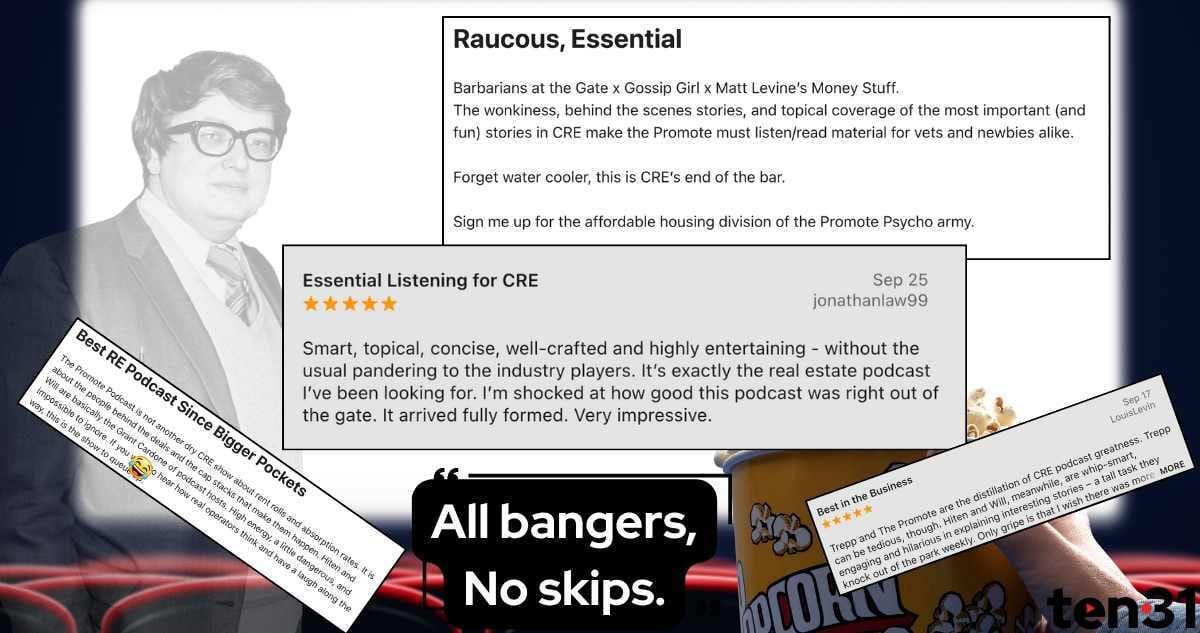

The People Have Spoken 🎙

Here’s a challenge for you. Pick a CRE podcast, any CRE podcast. Go listen to the first 10m of it. Clock how it makes you feel and what it makes you think. Then go and listen to The Promote Podcast. We’re playing a different game here.

Our latest episode: Brookfield’s $10B play for YES! and how the Flatts of the world must chase AUM in far-flung asset classes; RXR’s OPM masterstroke in Manhattan; and Buccini Pollin’s long game in Wilmington. Spotify here, YouTube here or Apple Podcasts here. To get in front of our obsessed audience of CRE insiders, reach out here.

Quickies

Satmar pezzonovante™: Yoely Landau gets the Mispacha treatment (See also: The Promote’s Nursing Home Power Roster) 🛀

Another Nathan Berman office-resi wipeout - more on this Monday 💯

Unquotable Quotes

“I would never let anybody [describe] an office building of this caliber being Class A. So it’s called Class X. ” 😼 🦁

- Black Lion’s Robert Rivani, on expanding the CRE dictionary w/ his Miami Beach project