Carlyle’s Box-to-Box Playbook

Carlyle has exited a NYC self-storage portfolio for big dollars

“Human laziness has always been a big friend of self-storage operators.” - Derek Naylor, Storage Marketing Solutions

When we did the math on Carlyle’s blockbuster NYC self-storage portfolio sale to a StorageMart JV, we thought we screwed up. The $1B buy was penciling out to a staggering $790/ 🦶 – that’s around twice what many Manhattan office towers are fetching nowadays. But no, the math was sound, the kind of number only possible when regulatory arb and a 1/1 buyer collide.

We’ve spent much ink in these pages on Carlyle’s approach to the New York market. After getting bodied in the mid 2010s buying high street retail via 60 Guilders (Kevin Chisholm, Bastien Broda), Carlyle has in recent years opted for a less glam approach, partnering w/ local operators to put together multi and self-storage portfolios nibble by nibble. The goals: achieve the kind of scale that allows for a portfolio-wide refi w/ cheap debt, as it did w/ its walk-up empire late last year; or attract a whale willing to pay top dollar, as it has just done👇

What's on Tap - Feb. 2

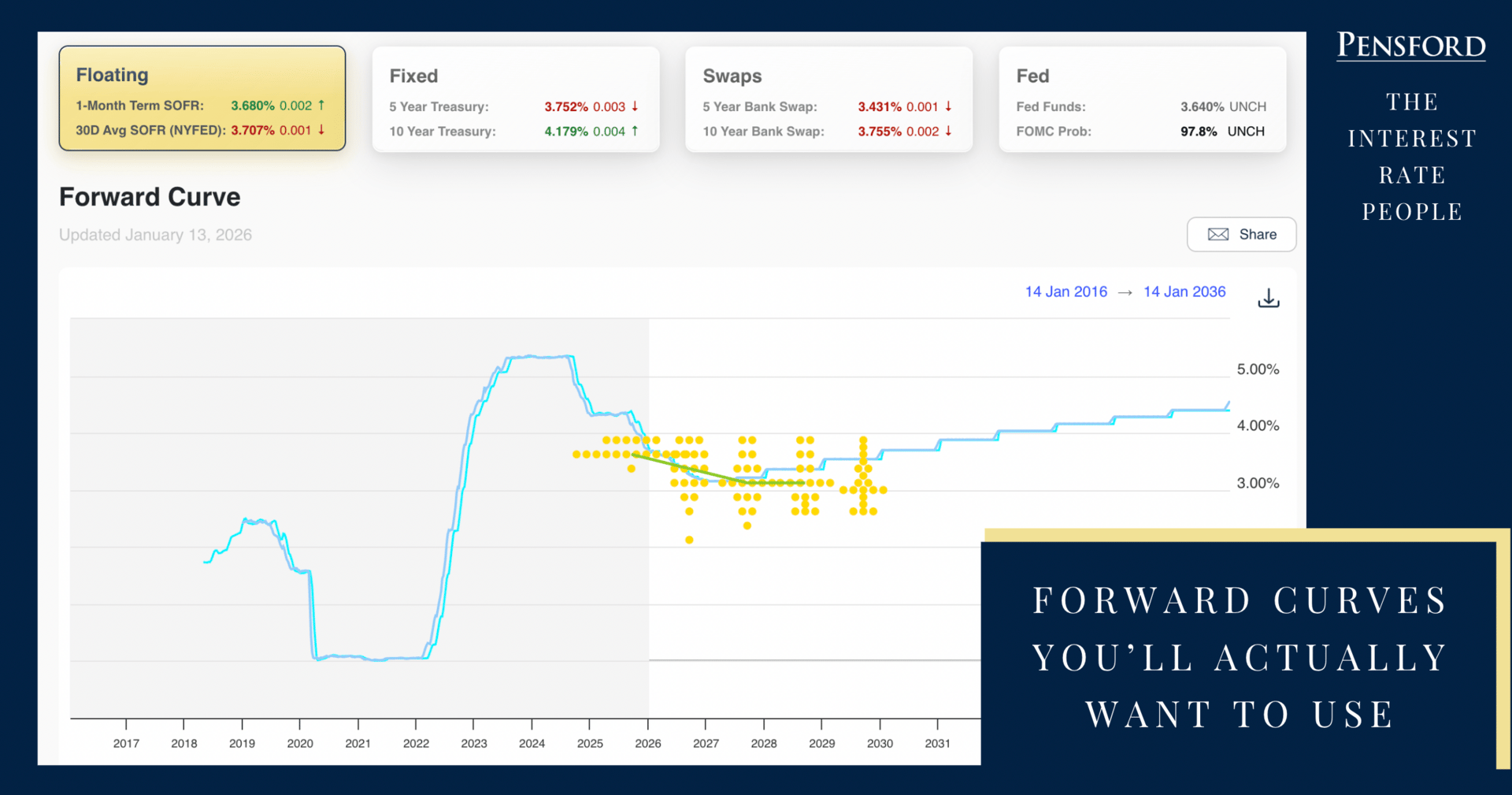

Pensford: Kevin Warsh Nomination - 3 Things to Know

A 🖋️ from Pensford’s JP Conklin: By year-end, the promise of lower rates became a baseline requirement rather than a winning argument for landing the Fed Chair job. Kevin Warsh recognized that to win, he needed to offer something the others didn't: a target for Trump’s frustration. Well played sir – Promise lower rates as part of the positioning but really hammer the Fed itself. Let’s dig into the 3 most important things CRE players should know about the soon-to-be MVP in their lives.

Carlyle 🍱 (Cont.)

The firm began amassing 🗽 self-storage properties in ‘17, and revved up the acquisitions engine after ‘20, when the city excluded such facilities from a popular tax abatement known as ICAP (the incentive was meant to spur job creation; self-storage joints tend to be automated 👻 towns). It partnered w/ 3 key groups: Long Island-based Sabharwals (fun profile of patriarch Harsimran Singh here); Long Island-based Blumenfeld Development; and Brooklyn-based Z+G (also Carlyle’s guys on the bigger multi buys). “Storage in a way is a derivative of multifamily without the regulatory headaches,” is how one deal insider put it, re. to political headwinds in the latter. “It’s a bet on where New York is going.” Deal sourcing in the space, in his words, is a “weird black market,” characterized by lots of direct trades – once a buyer like Carlyle is known to be shopping, the hotline rings ☎ This was the case, for e.g., w/ 25 Remsen Ave in East Flatbush, which the Cayre family sold to Carlyle for $50M last spring. PGIM has been a frequent lender on Carlyle’s deals. In Jan., Carlyle recapped the 1.3M sf, 15-property portfolio (≈ 26K units) to pave the way for the mega-transaction w/ StorageMart.

StorageMart, which today is majority owned by 🐏 Stan Kroenke, also counts Cascade Investments and Singapore’s SWF GIC among its backers – the REA story on the new deal notes “an unidentified sovereign wealth fund” partner on the trade. The new owners have tons of room to run: economic occupancy – a key metric in the asset class – is at just 46%, and in-place rents are ≈ $35/ 🦶 StorageMart is set to rebrand the properties under the Manhattan Mini-Storage umbrella; it bought that firm and its 3.1M sf portfolio from the Gottesman family’s Edison Properties in late ‘21 for a record $3B ($967/ 🦶).

Eastdil ran riot here. Kieran O’ Shea - who also did the ‘21 deal – brokered the sale, while colleague Grant Frankel arranged $615M in acquisition financing (loan basis: $470/ 🦶 if for the entire spread) from Citi (h/t CMA).

Taking Back the Keys from KeyCity

Tie Lasater’s portfolio is characterized by widespread foreclosures, lawsuits and liens

(Editor’s note: Promote Insider contributor Ed Bond spends an unhealthy amount of time in the netherworld of NPLs. That gives him unique insight into the tawdrier actions of self-styled “business titans,” and today he explores, in forensic detail, one such specimen: multifamily syndicator Tie Lasater. Enjoy, and consider signing up for Insider if you want more expert breakdowns like this - HS)

By Ed Bond

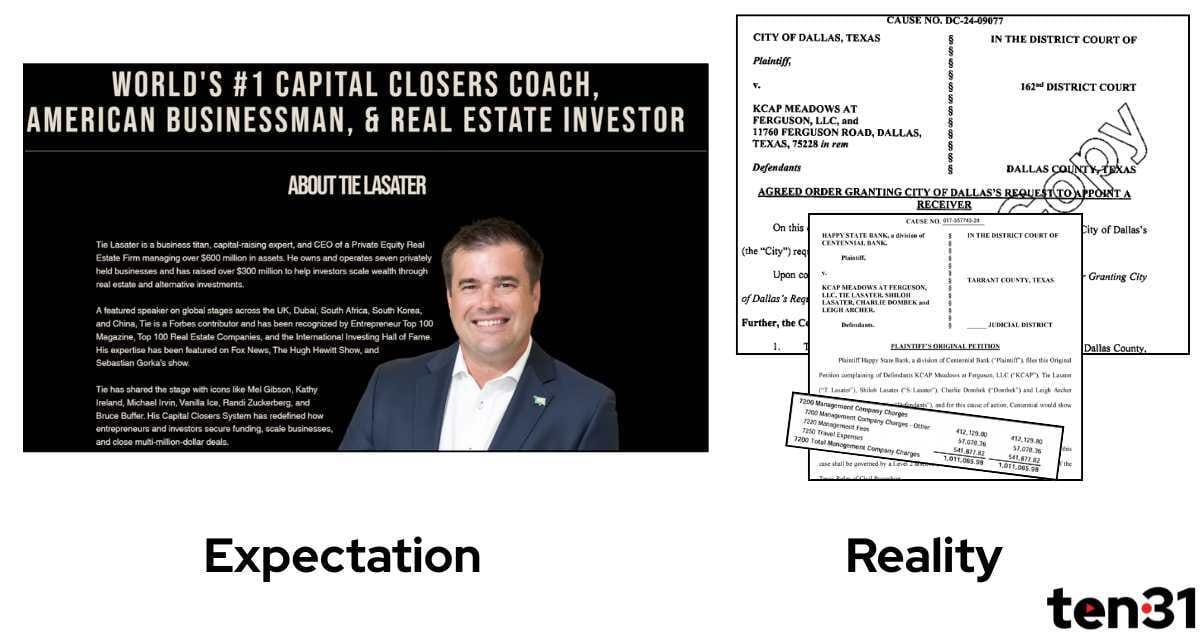

Do a speed run through the KeyCity Capital universe, and you get the textbook (or magazine cover) example of a successful real estate investor: Its head honcho, Tie Lasater, bills himself as “#1 In the World at Connecting Capital to Wealth.” The company, now rebranded as Lasater Capital, describes itself as a “values-based, growth-oriented financial services company built on the principles of integrity, trust, and communication,” and promises investors the opportunity to “build generational prosperity through disciplined investment.”

But upon closer inspection of their deals, both those values and the prosperity they promise are called into serious question. In reality, Lasater has a history of charging retail investors steep fees, has repeatedly made clear misstatements of material facts, and has a damning track record of foreclosures. Let’s dive in. We’re going to show you exactly how it all went down.

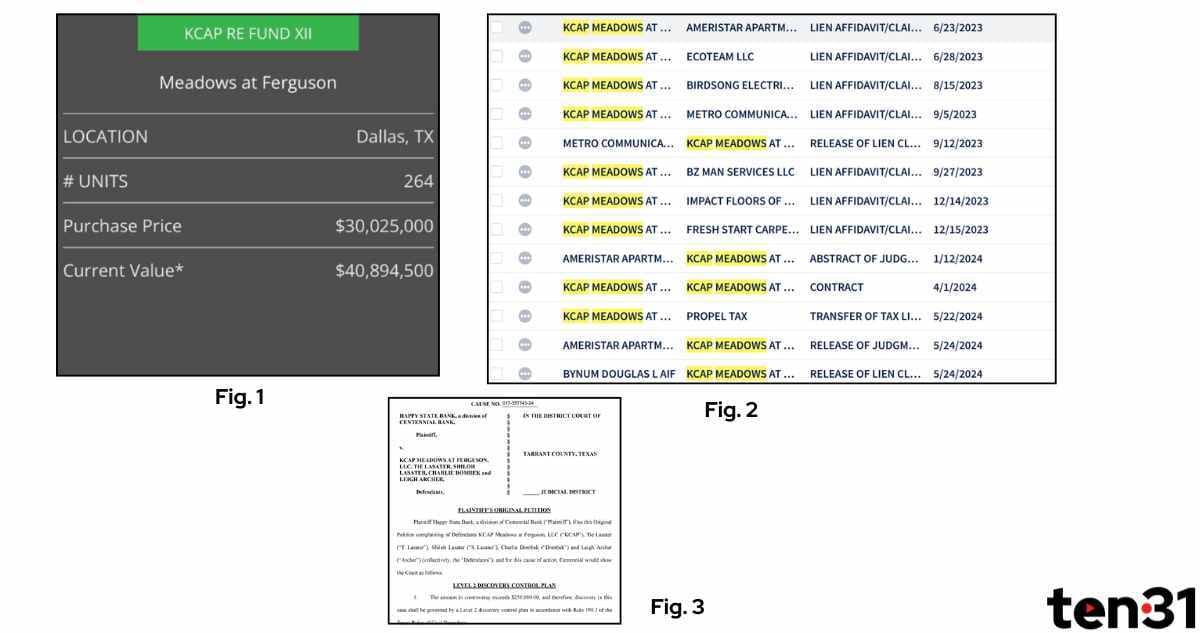

I: Contagion

In June ‘24, I stumbled upon a foreclosure complaint in Lee County, Florida, involving three single-family homes. The entity behind the properties traced back to KeyCity. As an NPL buyer, I’ve learned that distress generally metastasizes; it is usually not restricted to a single asset. KeyCity’s portfolio page immediately caught my attention: It was largely Class C Sunbelt multi, much of it bought in ‘21 and ‘22. This is the exact product type that investors fueled by ZIRP-era debt loaded up on coming out of the pandemic, and that is now seeing widespread distress (See The Promote’s recent Alan Stalcup interview and coverage of S2’s private REIT woes). But somehow, KeyCity’s portfolio was in good standing – or so the firm claimed. Every property had the purchase date, purchase price, and "current value" stated. The information has since been removed, but here’s one screenshot (Fig. 1):

Texas is a nondisclosure state. Advertising your purchase price is a gift to taxing authorities. More concerning, though, was the valuation metric itself. KeyCity provided a "Current Value" disclaimer stating these figures were determined at its "sole discretion," and weren’t intended to represent actual market prices. Regardless of the disclaimer, the current values were not grounded in reality. In fact, Meadows at Ferguson was already showing signs of distress. The property was littered with liens (Fig 2.) By Sept. ‘24, Happy Bank sued (Fig. 3) over a loan on the property. The lender didn't even bother to foreclose. Instead, it decided to pursue the guarantors. This may have been because of 1) the condition of the property and 2) to try to get ahead of other creditors. For the past 16 months, Happy Bank has been trying to sell the note. I know this because multiple brokers have approached me requesting note financing. One of the guarantors even tried to buy it – check out my X thread. Today, the property is in such shambles that the City of Dallas had a receiver appointed in early January.

(Read more from Mr. Bond: 1. The Influencer, the Refi, and the Rapid-Fire Default 2. Capstack Chronicles: One River)

Meadows at Ferguson will eventually join other KeyCity properties in the foreclosure pile. Last June, Arbor Realty Trust foreclosed on KeyCity’s 1,240-unit portfolio in Memphis. Just a year prior, KeyCity’s website claimed the package was worth $110M, a 34% leap over its ‘21 purchase price. In August, KeyCity also lost the 145-unit Canyon Village in Bryan, Texas, and the 100-unit Joshua Landing in Joshua, Texas, to foreclosure.

That hasn’t stopped Lasater from revving up the fundraising machine on social media. Here’s an Instagram ad for Fund 14, targeting a $1B raise😀

Lasater Capital’s Insta ad

“In 20+ years managing over $500 million in assets,” it proclaims, “we’ve never lost investor capital.”

II: Capital Calls

KeyCity continues to ask investors to help it save other assets. In October, I detailed how the firm commenced capital calls in the second half of ‘25 and into the new year. Merchants Bank of Indiana – a lender that’s been caught up w/ the likes of Moshe Silber and Aron Puretz – is threatening foreclosure on a 5-property, 894-unit portfolio in Montgomery, Alabama. Despite a receiver already in the mix, KeyCity is still issuing capital calls and telling investors the portfolio is worth ~$111K/ 🚪 . Comps suggest the actual value is around half that. And it’s a similar story in Texas. At the Hive in Dallas and the Dominik and Holleman Oaks in College Station, the firm is issuing capital calls based on exit values that even the rosiest appraisal couldn’t support, and even the most starry-eyed buyer would not pay.

Ok, we’re warmed up. Let’s go granular into the bankruptcy filings.

III: Skipping Straight to Chapter 11

KeyCity has recently thrown properties into bankruptcy to stave off foreclosures. In Q4, 3 KeyCity entities – KCAP Dominik LLC, KCAP Villa Gardens LLC, and KCAP RE Fund II LLC – filed for Ch. 11. Two important discoveries from the KCAP Dominik LLC filing:

(Promote Insiders: read on at the end of this email 👇)

Quickies

Bombshell scoop doesn’t even begin to describe this: Sheikh Tahnoon, Trump, Witkoff, crypto, AI data centers… it’s all here

Golden age of pvt credit: Apollo chief Marc Rowan consulted Epstein on firm’s tax affairs

Welcome to the 🌎 Caroline Edythe Temel!

Happy b’day Pras! Love you 😍

Unquotable Quotes

“It’s all noise, just drive.” 💪 🏎

- Michael Shvo, on reports that BVK is preparing to boot him from the Transamerica Pyramid

Lasater - Conclusion (Insiders-Only) 🔒

Continue reading with The Promote Insider

Unlock this story and all premium content. Start your free trial.

BECOME AN INSIDERWhat you get:

- Exclusive content: Weekly deep dives, deal memos, insider breakdowns, and interviews

- Expert columns: Analysis from the investment and capital markets trenches

- Bonus podcast episodes: emergency pods, Q/As, deal walkthroughs