RICO Suave

DC landlord Sam Razjooyan is accused of violating RICO

Notorious DC rent-stabilized landlord Ali “Sam” Razjooyan and his family members have been hit w/ a RICO lawsuit for “systematically” defrauding the District and lenders, in what the DC AG says is the first time an area landlord has been hit w/ a RICO violation – the law is best known for taking down mafia bosses and the like. “The Enterprise is running a Ponzi-like scheme,” DC’s complaint states. “It has no interest in the upkeep of the numerous multi-family residential properties it has acquired. To the contrary, it is content to have the properties remain in or deteriorate into deplorable condition, leaving the tenants to suffer the consequences, so long as it is able use the properties as bait to secure an ever-increasing number of sizeable loans. It then uses the loan proceeds to line the pockets of the Defendants.” The allegations made against Razjooyan and his family, as reported by the Washington City Paper (h/t reporter & Promote reader Suzie A. 🫡 ), are quite something 👇

What's on Tap - Feb. 16

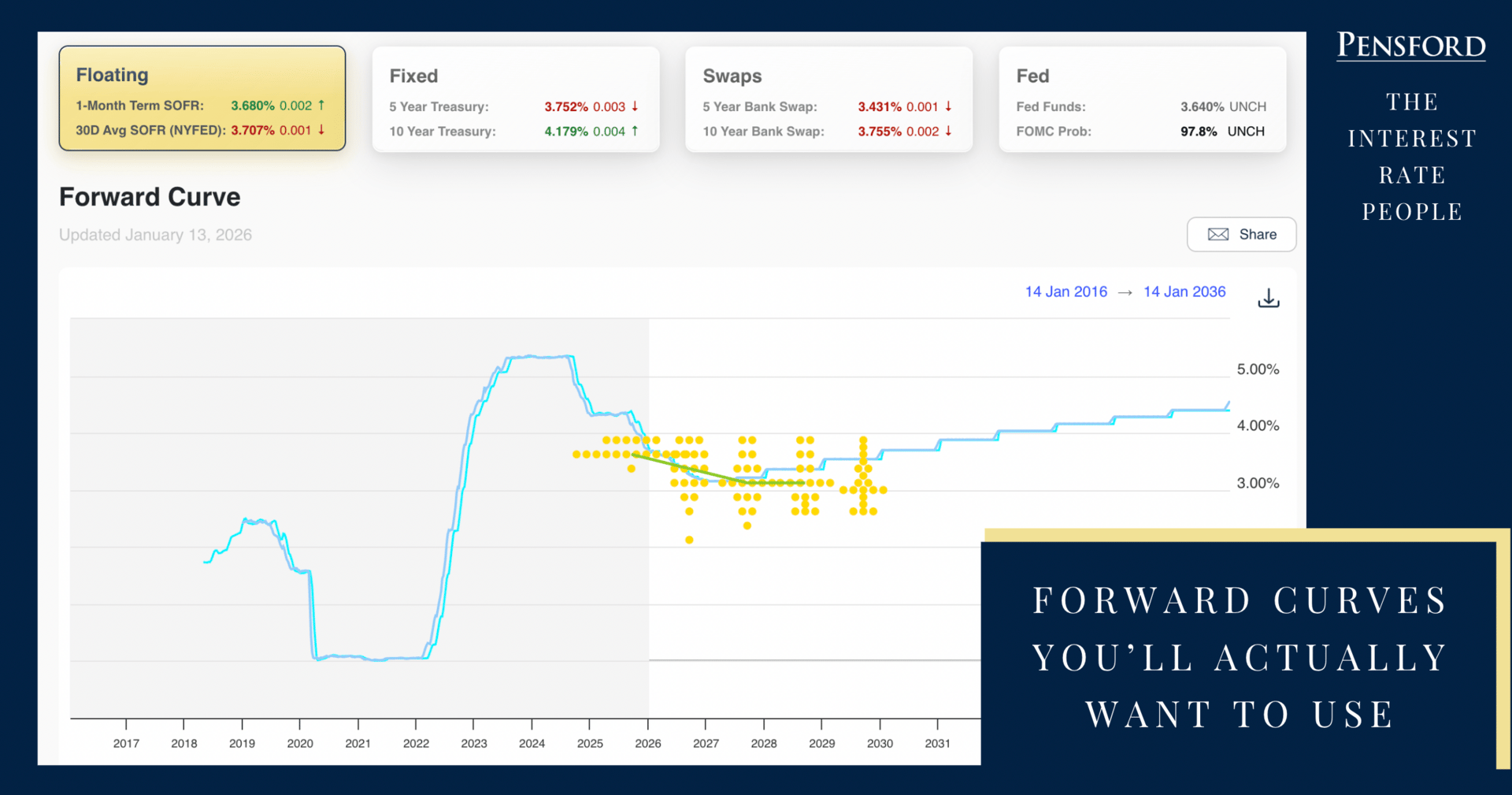

Pensford: A Jobs Report Reality Check

A 🖋️ from Pensford’s JP Conklin: CBRE loses both Tony and Bryan in the same week and its stock falls off a cliff? Coincidence? Happenstance? As much as Tony/Bryan wish they had that kind of influence on CBRE’s stock price, the truth is that CBRE got swept up in the SaaSpocalypse last week. But like all good brokers, never let the facts interfere with a good story. I can almost hear Bryan arguing that the forward multiple of leadership is a real thing… Read on!

WATCH: Moguls Get Malörted by the Sears Tower

Blackstone is shopping the Willis Tower, another giant humbled by the skyscraper whose ownership and lender history reads like an industry’s who’s who. From gold mining maharaja Peter Munk to the girthy Brothers Chetrit, the Sears Tower has tested the best of ‘em. We journey through the building’s wild deal history on YouTube. We’ll be doing more of these videos on projects & players x the country, so smash that subscribe button and ✏ w/ suggestions.

(For even more capstack deets/history on the tower, Promote Insiders can read this.)

RICO (Cont.)

The Razjooyans allegedly used fake docs to score financings, made promises to lenders that they’d score higher rents by leasing to voucher holders, offered up fake certifications of building safety, even used straw men to acquire properties and get loans once the Razjooyan name became sullied. RICO allows DC to lay the smackdown on the whole portfolio (≈ 70 buildings, 600 units) rather than on individual properties, and the district seeks to bar the Razjooyans from owning/operating apartments (à la NY AG Tish James’ action against Rafi Toledano), force them to pay restitution to tenants and financial penalties, and have the properties placed under receivership.

Look, the lower-end apartment business is a really tough business for an operator. The laws are stacked in favor of tenants, and holding a nightmare tenant to task is nigh impossible (good anecdotal rundown here). Regulatory headwinds can be extreme, as we’ve seen most notably in NYC post ‘19 rent reforms, and you can end up w/ high drama as we just saw w/ the Pinnacle/Summit situation. HOWEVER: The laws get that way partially because every so often, you have a scumbag landlord who runs roughshod over tenants and the situation gets desperate. If the industry was better about calling out its worst actors, things wouldn’t be nearly as lopsided.

Is a Global Network Irrelevant for NYC Deal Flow? 🌎 🗽

The big brokerages always tell you how cosmopolitan they are, how they can wrangle their brightest minds from London and Riyadh to get your listing meaningful global distribution. But as a seller of a New York City property, should you give a single hoot? Absolutely not, says Bob Knakal. The vet broker, who cut his teeth at CBRE, built his Massey Knakal into a beast before selling it to Cushman and then worked there and JLL (both stints ended poorly, tbf) before once again going indie, has a spicy new column in which he argues that a global footprint advantage is “largely fiction.” While he was flying a big firm’s flag, Knakal says he brokered 538 sales which yielded 9K+ offers – not a single buyer, or offer for that matter, came via an int’l colleague. NYC is of c a 🧲 for foreign capital, but SWFs and other outside players tend to go through NYC-based brokers or JV w/ local operators, he noted. He then takes a dig at the powerhouse lads at Newmark (there is well-documented beef between them from their Cushman days), in regards to the Spitzer/Winter listing that is now set to be Miki Naftali’s 800 Fifth. “The brokers pitched their ‘international network’ as a selling point,” Knakal writes. “I told the seller that was BS.” It’s a pretty provocative piece, one likely to ruffle some feathers at the big shops (just picturing Riguardi reading this w/ his Diet Coke), and worth checking out.

Nipponomics 🤝 Take-Privates

We’ve discussed previously how as Japan’s population continues to decline, their CRE giants are eyeing greener pastures stateside. Sekusui House bought MDC Holdings in a $4.9B take-private in early ‘24, Daiwa House teed up a $500M investment in Alliance Residential that fall, and Sumitomo Forestry 🎋 had announced its intent to build 10K units/Y w/ a Sunbelt focus. Sumitomo Forestry (≈ $6.6B market cap) is now accelerating those efforts by acquiring homebuilder Tri Pointe in a $4.5B take-private - that’s a hefty 29% premium to Tri Pointe’s stock price prior to the announcement. As we’ve been saying on the pod (listen to “Going Wholesale at 23:30 here) a bunch recently👇 , it’s a godawful time to be a REIT, and many are selling themselves to the AUM Gobblers ™ or liquidating properties and dissolving (Aimco’s sunsetting makes room for the likes of Respark/LaTerra and the Oak Row lads to ride). Tri Pointe will be part of the Sumitomo Forestry group of brands but will keep its name. Loved this line from the announcement about new sheriff/old sheriff dynamics: “Sumitomo Forestry has a proven track record of respecting continuity and the autonomy of local leadership.” 🎎

Quickies

Jamestown stepping in to recap, lead NC megaproject known as Camp North End (Hemmerdingers’ Atco will move into background, Shorenstein will hold its piece) 🪖

Sonder implosion compounds headaches for BH3 (“What the fuck do these guys think we are, baggage handlers?”) at SoFla resort

Unquotable Quotes

“We’ll fucking bankrupt this city!” 💢

- NYC landlord Humberto Lopes (in a wonderful retro Brooklyn accent), urging his peers to not pay property taxes in protest of Mamdani’s “Rental Ripoff” hearings