Me, Myself & Apollo

A lackluster Apollo REIT is selling its $9B CRE loan book to rip-roaring insurance unit Athene

Over the last couple years, Apollo pioneered the reimagining of the once-unsexy field of insurance as a source of equity that it can then feed into its PE machine. As friend of The Promote Hunter Hopcroft explored last year in what increasingly feels like a seminal essay: “Apollo, in effect, leverages their insurance equity via the private equity structure to earn fees and carried interest on the debt those platforms are originating. The portion of that debt origination that qualifies as investment grade can be fed back into the top of the insurance capital stack, dropping down new equity that is used to equitize further debt origination.”

If you’ve got that kind of symphony going, why continue to get rocked in REITworld?👇

What's on Tap - Jan. 30

🎙 Condo Kingpin’s Next Act & Proptech Falls off Wall

“You've got to keep the flow of money going to create that illusion that everything is okay. As long as it’s flowing, all sins are forgiven in commercial real estate.” 🙈 🙉 🙊

This week on the pod, we discuss 2nd acts: Ziel Feldman has left the scandal-ridden past of his glitzy NYC development firm HFZ Capital behind, and he's reinvented himself as an affordable housing player. We trace the wild arc of his career and his far stealthier new game. Proptech's loudest voice Fifth Wall is now yelling into the fundraising void; we look at how the firm's issues are emblematic of the broader sector. Plus, a "Pardon the Interruption" style rundown of the newsiest industry happenings: S2's REIT hiccups, Charles Cohen's latest foreclosure, and Shvo's media mastery.

💗 to our sponsors:

1) LoanBoss, the industry-leading debt management software: 1-click covenant testing, instant cash flow forecasting, and live forward curves!

2) Bravo Capital, a leading HUD and bridge lender. See how their precision underwriting means speedier approvals and higher proceeds for sponsors.

Listen on Spotify here, YouTube here or Apple Podcasts here. Brands: To get in front of our obsessed audience of CRE insiders, reach out here.

On Wednesday, subscribers to The Promote Insider got the definitive deal history of one of the world’s most famous skyscrapers: the Sears Tower. W/ Blackstone hoping to ditch Jon Gray’s hometown totem, it’s a perfect time to dive into the dizzying array of JVs (Chetrit 🤝 Goldman 🤝 Cayre!) and capstacks that got us here. Plus, we have news of a warning sounded by feeder fund Trinity over the S2 rescue pref raise. To get the deets that matter, sign up for Insider and read it here.

Apollo (Cont.)

With shares of Apollo Commercial Real Estate Finance (ARI) consistently trading well below book value, the REIT has decided to sell its $9B CRE loan book to Apollo subsidiary Athene, where the water’s a lot warmer. (In an amazing self-attaboy, Athene agreed to pay a 20% premium to recent trading levels, per the FT, and ARI said this “validates” its book value 👏 ) The book includes NPLs such as the debt on JDS & PMG’s 111 W 57th St (a project that deserves its own mini-series tbh). ARI CEO Stuart Rothstein said it flat-out: “There seems to be much greater value placed on what we do from an origination perspective in the institutional market than in the public market right now.” Translation: Private markets give you more cover to make exotic bets. 🐆

The Athene crew were in perfect harmony w/ him, saying that “we are already invested in the capital structure across nearly half of the loans in the portfolio, giving us deep first-hand familiarity with the assets and their credit quality.” 🤗 Asset-backed loans hit the spot for such money managers, b/c they’re more likely to meet the insurance book’s investment-grade criteria. And Athene has rapidly become an alpha dog in CRE lending: it topped CMA’s ranking of top insurer lenders 2Y in a row, originating $10B+ in ‘24 (+41% YoY). It’s muscling in on some of the market’s marquee transactions, and even bought itself a C-PACE lender to get in on that growing action.

What’s cute is that Apollo has previously called out related-party transactions by rivals KKR, Blackstone and Brookfield - Brookfield is, of c, the 🐐 of the CRE RPT.

Newmark Snatches Office Sales Crown

Newmark took national honors in the office I-sales rankings. Runner-up Eastdil won the 3 top markets

Barry Gosin has finally realized his dream of office-sales supremacy. His Newmark took the top spot for the v first time in Green Street’s ‘25 office sales ranking, seen as the ultimate flex in institutional brokerage. Newmark brokered $9.3B (up 24% YoY) worth of deals (Only $25M+ trades make the cut), w/ daylight between it and its closest rivals: Last year’s champ Eastdil was at $7.5B (down 5% YoY), followed by JLL at $7.3B (up 27.6% YoY) and CBRE at $7B (up 76% YoY). Cushman placed 5th w/ $2.9B (up 27% YoY); no other firm cracked $1B.

A closer look reveals some interesting patterns: Eastdil took the honors in the country’s 3 hottest markets, which were NYC ($10B in deals overall), SF ($3.2B,) and the D.C. metro ($3B). Eastdil’s dominance in SF, where sales volume was up 209% YoY, is notable – the firm had 55% market share. It also ran point on the year’s 3 largest brokered deals. Newmark, though, racked up the numbers w/ podium finishes across so many cities, that it ended up doing over a quarter of all brokered deals. Overall, the sector showed a real resurgence, w/ sales volume jumping 35% YoY to $55B. Q4 in particular was off the chain – 45% of the year’s deals happened in that period 👑

OMG. I Can't Believe I Missed Your Call

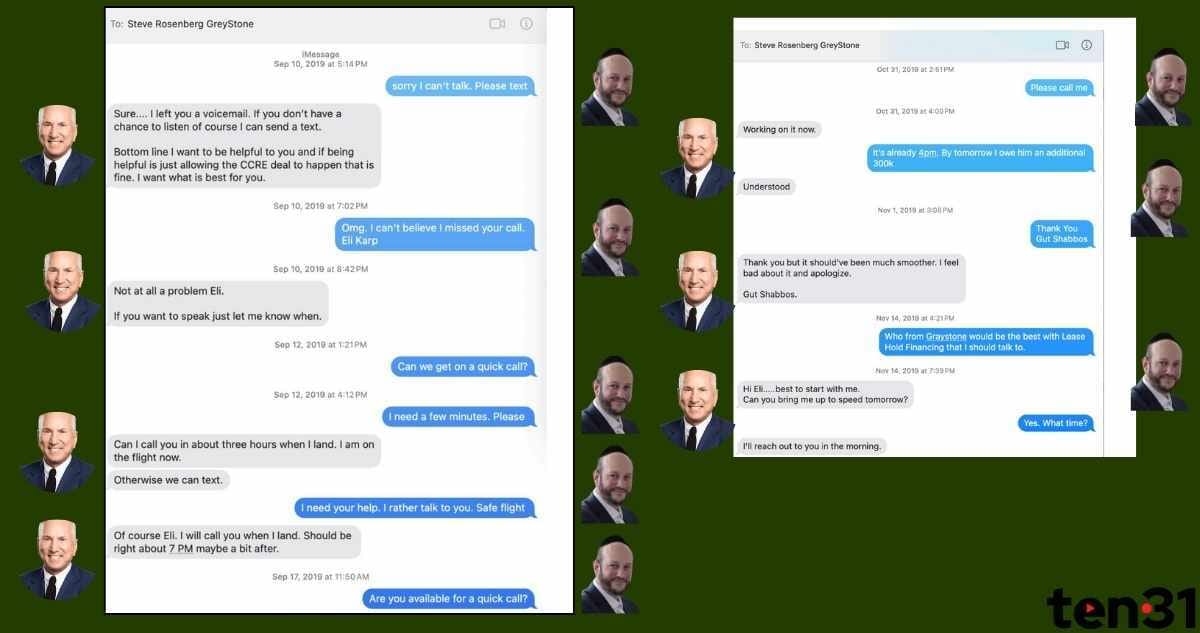

A new lawsuit provides a rare glimpse into sponsor-lender comms

Hello Drama. So, Brooklyn developer Eli Karp is suing his lender Greystone & appraiser BBG, alleging the 2 were in cahoots on a loan-to-own scheme at one of his former Brooklyn properties that put him on the hook for $15M in PGs. The particulars of the suit – you can go read about them here – are a bit meh, b/c Karp has a history of blaming everyone but himself for his boulevard of broken deals. But one exhibit is electric: it’s a series of texts starting in fall ‘19 between Karp and Greystone boss Steve Rosenberg. It’s rare to get an unfiltered look at a sponsor-lender tête-à-tête like this, particularly on a distressed deal. (Promote Insiders: read on at the end of this email 👇)

Empire State of Mind

Out of room today but few big things worth noting in 🗽

Ares, JPM provide $525M condo inventory loan to Witkoff/Blavatnik’s One High Line: Steve + Len will crush it here, after stepping in to the former HFZ joint (This week’s pod has a whole tick-tock of the HFZ chapter)

Rob Speyer making another run at the Chrysler! Terms still TBD, but presumably Abu Dhabi is like “that’s all you bro” this time around. Still confused why Savills has this skyscraper listing. Worth checking out our deal history of this Art Deco icon if you haven’t yet

The Amex —> 2 WTC stuff is back in the news. Pistolera 🔫 Lois Weiss first reported on this in late ‘24.

The Great Neck strivers have done it! (More context here)

Quickies

Aaaand scene: Texas syndicator (and 🧑✈ ) Devin Elder pleads guilty in federal wire fraud investigation, agrees to repay $66M (more context here)

More deets on the $300M+ that went from Nussbaum-controlled escrow accts. to Steiner-related entities (ICYMI our short film on this is a must- 👀 )

💯 need to add this guy to our CRE’s LinkedIn Lunatics crew

We’re hearing more WAGs of CRE dealmakers are getting addicted to the pod: Please, share your reasons why – we’d be honored to hear from you 🙋♀

Big 💓 to Evan B: We’re BACK on Insta! (Pod clips, video breakdowns ++)

Unquotable Quotes

“I don’t even know what more you could do to be in contempt. I really don’t.” 🤦 👩⚖

- Judge Andrea Masley, on OYO Hotels violating her orders in its battle w/ the Brothers Khimji

Thirsty Lender Texts - Conclusion (Insiders-Only) 🔒

Continue reading with The Promote Insider

Unlock this story and all premium content. Start your free trial.

BECOME AN INSIDERWhat you get:

- Exclusive content: Weekly deep dives, deal memos, insider breakdowns, and interviews

- Expert columns: Analysis from the investment and capital markets trenches

- Bonus podcast episodes: emergency pods, Q/As, deal walkthroughs