Taking the Miki: Penciling Out Naftali’s UES Megabet

Miki Naftali and Gary Barnett have both made their moves on the UES - what happens next?

Good developers pay up for good dirt. Great developers overpay for great dirt. It’s a maxim of New York real estate that has panned out again and again, most famously w/ Zeckendorf Bros.’ record-smashing play for the 15 Central Park West site($401M in ‘04!). But going in w/ the right playbook is crucial, otherwise you’re setting yourself up for disaster. In the wake of what looks to be Miki Naftali’s biggest-ever deal, an $800M+ bet on the Upper East Side, which depending on how you slice it equates to $2,300/ 🦶 on the low end to a whopping $3,000+ / 🦶 (more on that below), thought it’d be fun to look at what might be possible there.

What's on tap - Mar. 26

Powered By: Vintage Capital

There’s a reason mobile home parks are getting so much institutional love. They remain one of the key affordable-housing sources nationally, have limited supply and high tenant retention (10-12Y). Investors can see tremendous upside with professionally-managed MHP portfolios such as Vintage Capital’s, which targets a 15-17% IRR and makes monthly distributions. Invest directly in individual deals or via a 10+ property fund. 1031s also available. Visit the deal room now to get started.

Naftali (Cont.)

Naftali is in contract to buy 800 Fifth Ave from the Spitzer & Winter families, giving him control of a cash-gushing tony rental. But Naftali doesn’t wake up in the morning to collect rent checks; this is almost certainly a luxury condo play, the kind of project he’s had tons of success w/ in the wake of Covid, selling out (at top dollar) 200 E 83rd and 1045 and 1165 Madison, and landing a hefty $236M from JPM/Starwood to build his latest on 77th St.

How much dirt will he get to play w/ here, and what could he do w/ it? The tower as it stands is 356K sf, but it’s overbuilt, and w/o variances he might have as little as 282K sf for a ground-up project. Bake in the generous loss factor (foyers, elevators, other bells & whistles of wasted space you need in luxury resi), and he might be looking at a land basis of $3K+/ 🦶 He could stack up mechanicals to go higher. Or he could get to 340K sf by adding some affordable units - but that messes w/ the marketing to frou-frou buyers.

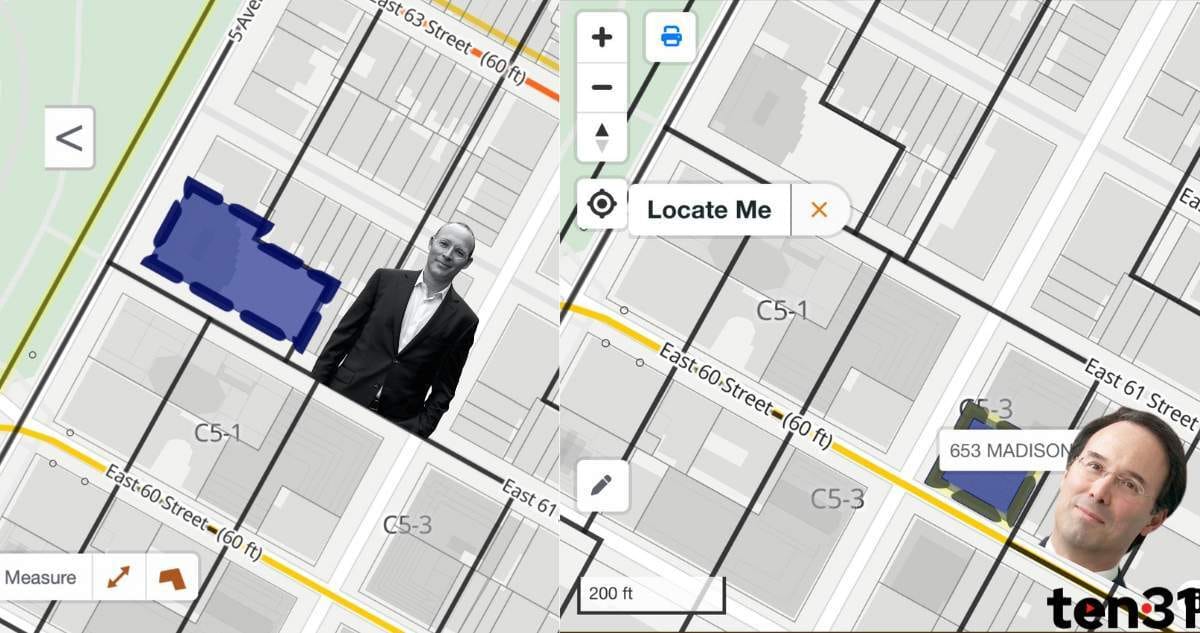

Maybe a fun comparison to be made here w/ what Gary Barnett is up to nearby: Our boy recently snapped up a site at East 60th/61st for $160M-ish from Williams Equities (pretty great price for Madison Ave frontage, mainly b/c Barnett had snagged an option to purchase the tower when the market was its lowest, per sources), then added to the assemblage in a $103M deal w/ Solil Management (had to pay up a bit for mid-block but all good). The crucial thing here is the retail: Unlike Naftali’s site, Barnett’s has C5 designation, allowing him to build retail space w/o sacrificing the juicy resi use 🥩. And that also allows him to quickly de-risk: Barnett reportedly is (was?) in talks w/ Chanel 💄 to pay mid $400Ms ($6,900/ 🦶 ) for the 65K sf retail spread at the project.

Naftali, in contrast, has R10 zoning, meaning he can’t take some chips off the table by selling a retail condo for a fat sum. (BTW, this is all a speculative thought experiment – Naftali declined to comment – so please take it as such, but I think a worthwhile one to do.) Which means, whether he has 282K or 340K sf to play w/, he’d have to command sky-high resi condo prices to make these numbers work. Luckily, he’s pretty good at that.

Naftali’s backers 💵 on this project will be worth watching, too: He was previously bankrolled on several projects by Nahla Capital, the Genghis Hadi-led firm that invests Gulf money in U.S. projects (it’s currently backing Naftali alum Victor Sigoura on the UES), but has recently found a partner w/ even deeper pockets: Access Industries, controlled by Len Blavatnik. We’ll see who joins him on this caper.

A Fox in the Lockbox

Cloud provider CoreWeave disclosed technical defaults on a huge Blackstone loan

We had riffed in May on how Blackstone uses both its CRE and PE muscles to plant its flag in the Gen AI field, looking at how it led a $7.5B pvt-debt financing into cloud-computing darling CoreWeave. The deal was structured as a “metaphorical lockbox” of sorts, w/ CoreWeave’s GPUs as collateral, as well as service contracts w/ top-tier customers. Now, there’s a bit o’ drama: As it puts the final touches on a $32B IPO, CoreWeave has disclosed that it had to ask Blackstone to amend the loan terms and to waive its so-called technical defaults, per the FT. CoreWeave didn’t miss loan payments; rather it made administrative screw-ups, including using some of the financing to expand into Europe, which was a violation of loan terms. One hedgie told the FT that the default casts a “horrific” light on CoreWeave’s internal controls; another described it as a “a dumb oversight at worst”.

One point to ponder: Nearly 2/3 of CoreWeave’s revenue last year came c/o Microsoft, which per a new note from analysts at TD Cowen has pulled the plug on 2 GW worth (that’s a LOT) of new data-center projects in the US and Europe. “We continue to believe the lease cancellations and deferrals of capacity points to data center oversupply relative to its current demand forecast,” they wrote.

The Promote Pod: New Drop

“Don't take notes. Don't write things down. They can never subpoena air.” ☁

“They're getting paid a ton of fees off the bat and just being in it is winning.” 🧃

“Rialto seems to have taken the stance on this, like in The Rainmaker when the insurance company just denies every claim and see who then like comes after them.” 🎯

Ep. 3 of The Promote Podcast is live, and it’s a doozy. We talk Related’s “Lufthansa heist” for the Signature Bank RS book, the bitter Newmark-Eastdil rivalry, and why 2 of the biggest banks are warring it out over a Chetrit Group megadeal. Listen on Spotify here or Apple Podcasts here. If you’re interested in advertising, hit us up here. And please, smash that SUBSCRIBE 🖋️ button and leave us a rating ⭐️⭐️⭐️⭐️⭐️ – we need the ten31 community to give this love to help it get discovered 🙏

Perot Family Seeks Big Industrial Payday

An industrial giant controlled by the billionaire Perot family is shopping a mega-portfolio

“If you see a snake, just kill it. Don’t appoint a committee on snakes.”- Ross Perot Sr.

With industrial as 🔥 as it’s been in a long time, one of the mightiest private firms is looking to cash in: Hillwood, which is controlled by the billionaire Perot family, is shopping a 16.8M sf national industrial portfolio, per REA, teasing the value of the package at $3B ($179/ 🦶 ). Eastdil has the 🦣 assignment, which would be the 3rd-largest ever industrial trade if it sold at the sticker price, per Green Street. For buyers w/ even bigger stomachs, Hillwood would be down to throw in an add’l 8.7M sf of under-development industrial properties for a TBD price. Meanwhile, the firm is separately marketing a European logistics portfolio at a $2B target price. A recent comp to consider: Rexford’s $1B purchase of a Blackstone package last May for $332/ 🦶

Hillwood was born out of the wealth generated by the IPO of Ross Perot Sr.’s Electronic Data Systems; Ross Perot Jr. kicked off the real estate biz w/ a 13K acre-deal in Ft.Worth, which became AllianceTexas. The firm is a major player in residential development, int’l infrastructure and, of course, data centers.

Quickies

Hairier the better: How Apollo uses complexity as a competitive advantage

Agency-lender lyfe: “Landlord friendly peeps are now in charge”

$80M buyer at Zeckendorf project sues developer over soon-to-be obstructed views 👀

Unquotable Quotes

“I can't explain it. It’s just something inside of me that the timing was right for me to go.” 🪞 😍 🪞

- Miami-Dade housing czar Alex Ballina, on the call of the wild - i.e. resigning to start his own Live Local Act-focused development firm.