Ch-ch-ch-ch-anges to Freddie SBL?

Freddie’s SBL program, long a lifeline for multifamily operators looking for a lean-and-mean financing option on petite deals, might be coming to an end as we know it. Word is that in the coming months the program could be folded into the Optigo Conventional desk; i.e. the unit that does larger multifamily loans. Underwriting for SBL deals is seen by some sponsors as cheaper, quicker and less onerous, and the program has been a go-to for $1M-$7.5M acquisition financings and refis on 5-50 unit deals. (Handy snapshot of typical terms here.) Arbor Realty Trust helped Freddie create the program in ‘14, and today there are a total of 10 lenders in the mix, including Pinnacle and Ready Capital.

What's on Tap - Feb. 9

Powered by: Bravo Capital

Bravo Capital doesn't do maybes. $2B+ closed in bridge and HUD loans since 2021. 100% HUD approval record – every deal submitted, approved. A recent healthcare Express Lane review took 4 days. Clean underwriting moves fast. With $750MM in institutional backing, Bravo combines institutional scale and a focus on relationships. See why more sponsors choose to grow with Bravo by getting in touch with our team.

SBL (Cont.)

CRE finance pros noted that the potential changes could be part of Freddie’s broader crackdown on mortgage fraud over the past 18 mos., w/ SBL deals coming under closer scrutiny. A source familiar w/ the agency noted that Freddie wants at least 2% of its loans to be on small properties that are affordable to low-income families (up to 80% AMI). W/ Freddie (and Fannie) bumping the volume cap by 20% to $88B this year, the source said the agency would be looking to do more business in the space, not less.

Meridian Founder Feud: Weinberg Moves to Collect

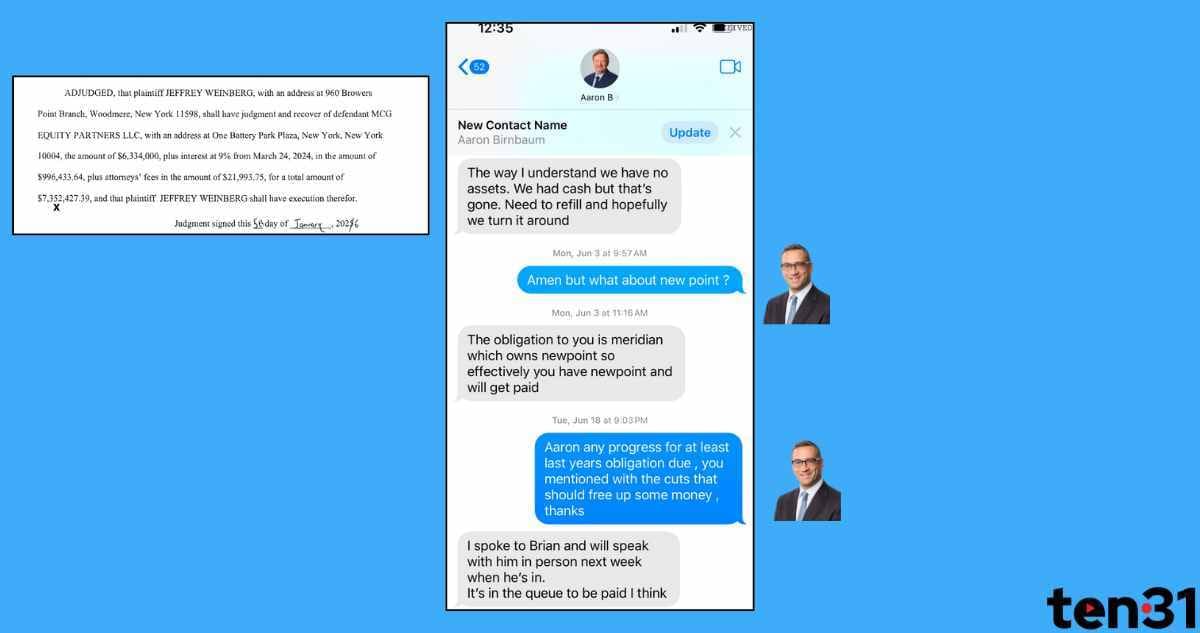

Weinberg submitted texts w/ Meridian’s Aaron Birnbaum as part of his bid to collect monies

Getting a judge to agree that your employer owes you millions of dollars is one thing. Getting to collect is a whole other matter. In the fall, Meridian Capital Group stalwart and former partner Jeff Weinberg won a $6.3M judgment ($7.4M w/ interest + attorney’s fees) against a Meridian holdco. over its failure to make stipulated buyout payments. Now, Weinberg is asking the court to force a sale of the debtor’s 65% stake in Meridian to help satisfy the judgment. Weinberg’s lawyer argues that the debtor can’t claim that it is broke when it holds a majority stake in another co., i.e. the brokerage. To support Weinberg’s claim that Meridian doesn’t have the cash to pay him and thus a stake sale is warranted, he includes as an exhibit a June ‘24 text exchange between Weinberg and Meridian big dog Aaron Birnbaum.

“The way I understand we have no assets,” Birnbaum writes. “We had cash but that’s gone. Need to refill and hopefully we turn it around.” We should note that Meridian’s situation has improved considerably since then: It had a windfall in the form of the $425M NewPoint sale last March, was cleared for business by Freddie, and benefited from a thawing in the capital markets. Still, Weinberg makes the case that given the debtor’s cash crunch and its refusal to answer his inquiries about whether it intends to pay, “New York law provides a clear remedy: turnover of the judgment debtor’s noncash assets so that the judgment may be enforced.”

🎙 Apollo's Sister Act, ICE Age & Doomed Tower of Power

This week on the pod, we discuss how the Chrysler Building has laid waste to the best-laid plans of so many global titans. With Tishman Speyer reportedly back for another go, we trace its rollicking deal history, from Jack Kent Cooke to Abu Dhabi. We then look at how the ICE immigration crackdown is putting another big ? on the multifamily market and leaving landlords in limbo. Finally, we chop it up on Apollo's sister act: REIT ARI is selling its $9B loan book to insurance arm Athene, and patting itself on the back for doing so. We also do a "Pardon the Interruption" style rundown of the biggest industry happenings: Carlyle's NYC self-storage mammoth sale; Brookfield's misplaced OZ fund; and Fed 🪑 nominee Kevin Warsh.

💗 to our sponsors:

1) Bravo Capital, a leading HUD and bridge lender. See how their precision underwriting means speedier approvals and higher proceeds for sponsors.

2) LoanBoss, the industry-leading debt management software: 1-click covenant testing, instant cash flow forecasting, and live forward curves!

Listen on Spotify here, YouTube here or Apple Podcasts here. Brands: To get in front of our obsessed audience of CRE insiders, reach out here.

Quickies

Hearing that Gencom paid in the $1.2M/ 🔑 range for the Ritz Central Park (Deal was announced last week sans price)

WATCH: Inside the Genesis bankruptcy auction (good content to get you hyped for eCap ✈ )

More fee juicing to come: Apollo, Schroders to launch a pooled fund for US pensions 🧃

Unquotable Quotes

“When you look at where Cirrus invests generally, it tends to be really only the top four or five markets in the U.S., where buildings tend to be taller.” ☁

- Cirrus’ Joseph McDonnell, on naming the firm after the wisps that form at very high altitudes