Unkindred Spirits: Partners Go Off-Piste as Fraud Allegations Fly

Fmr. development partners at a high-profile new Colorado ski resort/condo are trading allegations of fraud

“Oh, yeah, just one little drawback to this delightful winter sport. The high-speed crash.” - Irv Blitzer, Cool Runnings

It’s a tale as old as the pistes: A group of local lads dream of transforming their stretch of ski country into a haven for wealthy out-of-staters, and set about remaking a mountain before learning that development is hard. But this latest example, at Kindred Resort in Colorado’s fabled Keystone, has an additional daffy: allegations of fraud lobbed by an iced-out partner

Local entrepreneurs Ryan Geller, Shervin Rashidi, and Scott Russell first struck a deal in the 2010s w/ industry behemoth Vail Resorts to purchase a 4-acre parcel in River Run Village at the foot of Keystone’s ski runs. But development is hard, and in ‘20, w/ Vail’s repurchase option looming, Vail suggested to the trio that they bring on an experienced capital partner to get the project off the ground. In fall’ 20, it introduced them to Greenwich Group International, headed by Simon Milde, a fmr. top exec at both Kennedy Wilson and Jones Lang Wootton (JLL predecessor). By that Dec., GGI and the trio (One River Run Associates) had a deal:

• ORRA & GGI would have a 50-50 split on the GP economics (all fees, the promote)

• GGI would kick in between $500K-$2M (but not more than what ORRA kicked in)

• GGI runs point on the capital-raising; ORRA on the hotel + condo development

• All parties must sign off on key decisions and LPs

GGI made the offering more palatable to capital, and was able to bring both the C-Pace lender and pref to the table, according to a rep for GGI who requested anonymity to describe behind-the-scenes details. But in spring ‘21, just as the partners were about to close on the land loan, the Q of how much equity ORRA had actually put up surfaced ⛷ 👇

What's on Tap - Dec. 8

WATCH: The Blackstone Cubs 🐯 📺

When you hit a certain level at the most powerful firm in CRE investing, you face the existential Q: Should you stay, get paid like a sultan but continue to live your life in 15-minute meeting increments and serve the machine? Or should you go, give up that massive comp but chart your own path? From Kathleen McCarthy to Tyler Henritze, our snapshot of the Blackstone Cubs is now live on YouTube. We’ll be doing more of these videos on projects & players across the country, so write us w/ suggestions.

Kindred (Cont.)

While ORRA claimed it had invested ≈ $15.3M in cash equity, GGI discovered that ORRA had neglected to pay $6.8M in employee housing union credits, it alleged in court filings, and, instead, “Vail Resorts had provided these credits to ORRA as a conditional assignment upon Project completion.” To put it simply: A conditional pledge from a 3rd party is NOT the same as cash already invested.

The lender, a CO regional called First Bank, asked a GGI exec to sign a bad-bay carveout. But the exec, Steve Lorenz, refused to do so, citing concerns about ORRA’s alleged misrepresentations. First Bank pulled out, and ORRA moved to boot GGI out of the project, calling their partner a “sham business” and alleging that its incompetence led to lengthy delays and an add’l ≈ $70M in costs. In Feb. ‘24, the New York Supreme Court dismissed ORRA’s claims. GGI, in turn, alleged that ORRA misstated its cash equity and secretly transferred the property to a new entity controlled by ORRA’s principals, thereby stripping “the project of its principal asset and allegedly making ORRA judgment proof.” [In this 2nd allegation, we see shades of the Big Bank Battle of Chetritstan, a Wells. vs. JPM war in which Wells alleges the Chetrits exploited a scrivener’s error to shunt a parcel into another entity.]

In summer ‘22, the 365K sf project, w/o GGI in the mix, scored $233M in financing from the following sources:

•$55M in C-PACE from Enhanced Capital

•$140M sr. loan (not ID’d in announcement, but sources said it’s from 🇨🇦 lender Romspen)

•$30M in pref

•$7M in co-GP funds from Pure Development (Drew Sanders)

There is also (Of Course) an EB-5 (cash for green card program, primer) component here. EB-5 is typically structured as sr. to the pref, but jr. to the C-Pace. Here are Rashidi & Geller talking up the project to their regional center. A media sleight of hand here that insiders will love: The EB-5 page touts a Bisnow article, which called Kindred “the next step in Keystone’s evolution.” However, that article isn’t produced by Bisnow’s editorial team; it’s sponcon placed by Kindred itself 🪩 🫡 (This is why The Promote resists sponcon offers; it’s not due to some moral high ground but b/c most readers don’t really distinguish between the 2)

Though the state court initially granted ORRA’s motion to dismiss GGI’s allegations of fraud, an appellate court sided w/ GGI, and the case is creeping towards trial. GGI is looking to claw back the 50% promote on the project, per insiders, but there’s some nuance here: the project was way over budget (now somewhere in the $300M s), but condo sales blew past expectations; nearly 90% of the 95 units are spoken for, per the last comms from the development team. The available units are asking $2.25M-$6.25M, w/ pricing in the low $2K to mid $2K/ 🦶. Vail Resorts is operating the 107- 🔑 hotel under its RockResorts flag. In general, the demand for ski-in, ski-out type ventures has exploded: pricing has gone through the roof – word is that Barnett has been slaying it in Deer Valley – and developers keep upping the ante w/ increasingly ambitious projects.

GGI, repped in the dispute by Quinn Emanuel + Glenn Agre Bergman & Fuentes 💼, declined to comment. ORRA was repped by Lauren Tabaksblat, formerly of Brown Rudnick and now of Brithem; she couldn’t be reached for comment by press time, nor could Kindred. The project’s opening is imminent. ⛷

☕ bonus - More CRE dealmaking stories from the heart of ski country

• Our breakdown of Gary’s masterclass in Deer Valley

• Reed Hastings’ Private Powder

Quickies

Weird (or normal???) that Gov. Hochul spoke at SLG’s conference? REIT’s stock tumbled after below-consensus earnings guidance; change to dividend

BONUS: Our special mailbag episode w/ all your unhinged Qs: CRE casting couch, return-agnostic investing & best dumb-guy sectors 📫 🧠

Brad Zackson’s Fordham Landing files for Ch. 11 to stave off foreclosure (if you don’t know who Zackson is, please read this)

Being a top resi broker is this weird mix of success/Napoleon Complex: "Then, Flagg drove himself (he typically has a driver) to Beverly Hills to meet with the jeweler designing a pin for his tuxedo." 🤵♂

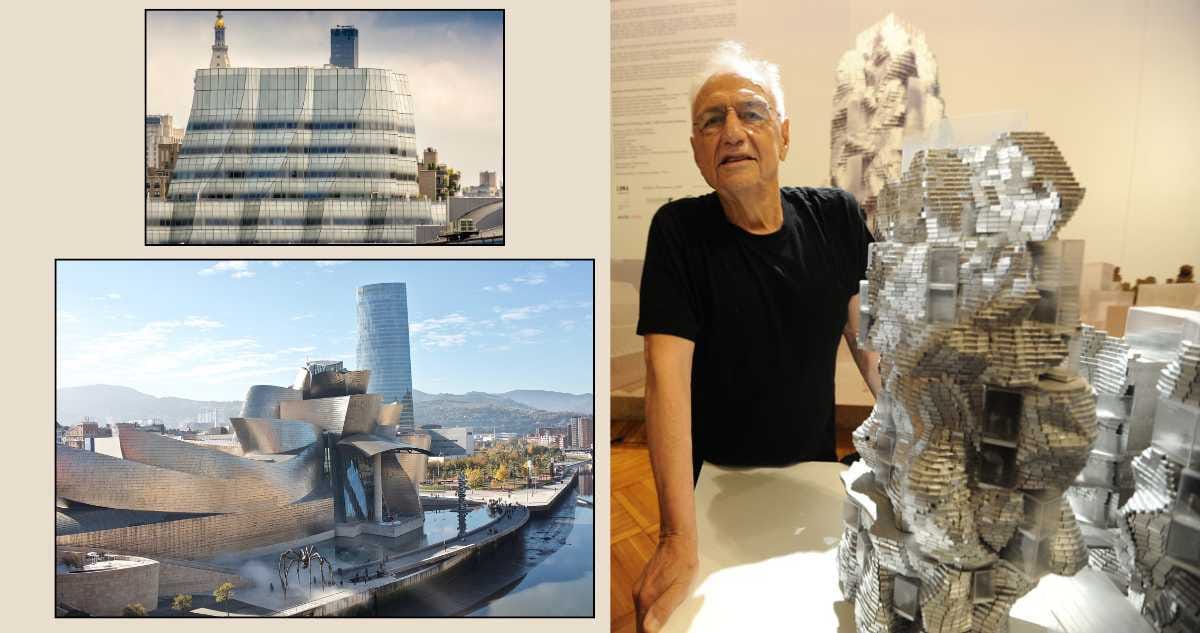

Postscript: Frank Gehry

Frank Gehry died last week at the age of 96. His skyline-shaping legacy is immense. (Credits: Naotake Murayama, Forgemind ArchiMedia at Flickr, CC 2.0)

There are a handful of good things to have come out of Canada: insulin, basketball, Jim Carrey. But perhaps the most consequential 🇨🇦 product for the world skyline was Ephraim Owen Goldberg, better known to us as Frank Gehry. Gehry died last week at the age of 96, another titan of design gone after a glorious, skyline-twisting run (see The Promote’s Bob Stern obit here). For a deeper sense of his architectural legacy, go here, or here. In our world, the Pritzker Prize winner was best known for his collabs w/ Forest City Ratner (Pacific Park master plan, 8 Spruce supertall), his 💌 to Barry Diller in the form of the IAC Building, and Related’s DTLA megaproject the Grand. He also had a long partnership w/ LVMH overlord Bernard Arnault, for whom he was designing a Louis Vuitton superstore on Rodeo Drive right until the end 👛

I mentioned Stern, and there’s an important contrast to be drawn between the 2 men. While both were brilliant, irascible and global totems of their craft, Stern was a developer’s dream – his buildings were, first and foremost, objects of consumption, amenable to pro-formas and familiarity and buyers’ desire for stuff more elegant than daring. Gehry, however, was a maverick. He could have designed facsimiles of his most celebrated work, the Guggenheim in Bilbao, for the rest of his career. But he refused. “You've got to bumble forward,” he once said, “into the unknown." 🙏