Barnett Gets TASEd

Gary Barnett has lined up a billion-plus capstack for The Torch - and more $ for CPT

He’s just so damn good at this. Gary Barnett has, yet again, landed a billion-dollar plus financing package for yet another outlandishly ambitious project. An unnamed bank is stepping up to give Extell up to $1.3B in sr. & mezz debt to fund the construction of “The Torch,” a supertall mixed-use hotel in New York’s Theater District 🎭 Barnett is also working on a deal w/ a hotel operator (has a ✒ LOI) that would backstop the construction & thus allow Extell to score another $150M in mezz.

What's on tap - Mar. 14

The Promote Podcast: Check Out Episode 1 👂 🎙

“It’s a crap building with a bad cap stack and Scott Rechler can write all the whitepapers he wants, but it’s not going to change that.”

“I know of a guy who put a mezuzah in an office building that was being foreclosed on and tried to claim it was his temple, so they had religious protections from his lender.”

“Aura is the lowest cost of capital.” 😎

Where else are you going to find this kind of spicy CRE commentary? The Promote Podcast is now live, and our pilot episode dives into Bad Boy Guarantees, a Midtown Skyscraper Ransom (14:20) & PIMCO’s loss of mojo (21:27). Listen on Spotify here or Apple Podcasts here. If you’re interested in advertising, reach out here. Please smash that SUBSCRIBE 🖋 button and leave us a rating ⭐⭐⭐⭐⭐ if you enjoyed it – we need the ten31 community to spread the good word 🙏 And stay tuned for Ep. 2 next week. 📻

Extell (Cont.)

We learn this via Bisnow’s report on Extell’s filing w/ the Tel Aviv Stock Exchange, where an Extell affiliate is incorporated. The TASE bond market is a source of institutional investor funds that Barnett has used to great effect on previous projects (One Manhattan Square, Central Park Tower), though it has also come w/ generous helpings of drama. Extell is projecting NOI of $250-$270M on the Torch, per the filing 🔥 No word yet on who the operator is, but I will note that Extell has a longstanding r’ship w/ IHG, which flies its 🎏 on Extell’s InterContinental Boston. Per hotel insiders, IHG’s Capital Investments team (Bastien Buffat) has long been trying to figure out an NYC partnership w/ Barnett; sources familiar w/ Extell, however, said IHG isn’t involved here.

In a separate filing, Extell disclosed that it has also raised a $270M condo inventory loan from Israeli bondholders, backed by 18 unsold units at the super (mega?) tall Central Park Tower. That $3B project has seen an astonishing array of debt & equity backers over the years, from Shanghai’s sovereign-wealth fund to Israeli bondholders to JPMorgan to the Reuben Bros.

FDIC disclosures show that CPC/Related’s winning bid for the Signature debt was 36% lower than a rival bid (meme c/o The Irishman)

"One citizen is equal to another (in the eyes of the law), but perhaps this one is slightly more equal than the others.” Silvio Berlusconi

Dealing w/ govt. entities is such an interesting game. Whereas in a private deal the main criteria are having the highest bid and being good for the money, the formula is murkier when dealing w/ Uncle Sam. Wasta (who you know) and who you partner with become essential weapons, and stark evidence of this comes via the FDIC’s bid summary on the $6B Signature Bank rent-regulated loan book. Related, in partnership w/ CPC and Neighborhood Restore, won one of the most coveted prizes in CRE finance w/ a $129.3M bid, despite a Brookfield/Tredway JV having made a $176.4M bid and 2 other bids from unID’d suitors (CO reported that Skylight/Rithm & Brooksville/Sabal were also higher bidders) in the $170M range. 🤷♀

Remember that, in a highly unusual move, the Adams administration had endorsed the Related JV bid, writing to the FDIC in support of it and citing the partners’ NYC affordable housing experience. Brookfield, meanwhile, accused the FDIC of running a covert process: “[We] have heard from numerous sources, including from your adviser (Newmark) and from media reports, that a winning bidder has been selected,” the firm wrote to the FDIC, “and that this bidder’s price is lower than ours.” A former Signature official had also called out the process for being politically rather than financially driven (“As my four-and-a-half-year-old granddaughter would say, “Serious?”). The official, George Klett, also argued that the structure provided no incentive for the winning bidder to have the loans pay off, b/c they only own 5% and are getting so nicely juiced by the fees 🧃 (The Promote got some more deets on the fee structure here). Meanwhile, Santander also got in on the Signature RS mix, paying $1.1B for a 20% stake in a $9B book around the same time.

Plenty of action on the Signature non-RS front, too: The Blackstone/CPP/Rialto JV that has been giving sponsors ulcers is looking to sell a nearly $400M chunk of the debt, per Bloomberg, having bought a 20% stake in the $17B book for $1.2B at the end of ‘23; it’s already offloaded chunks of it to Maverick & others.

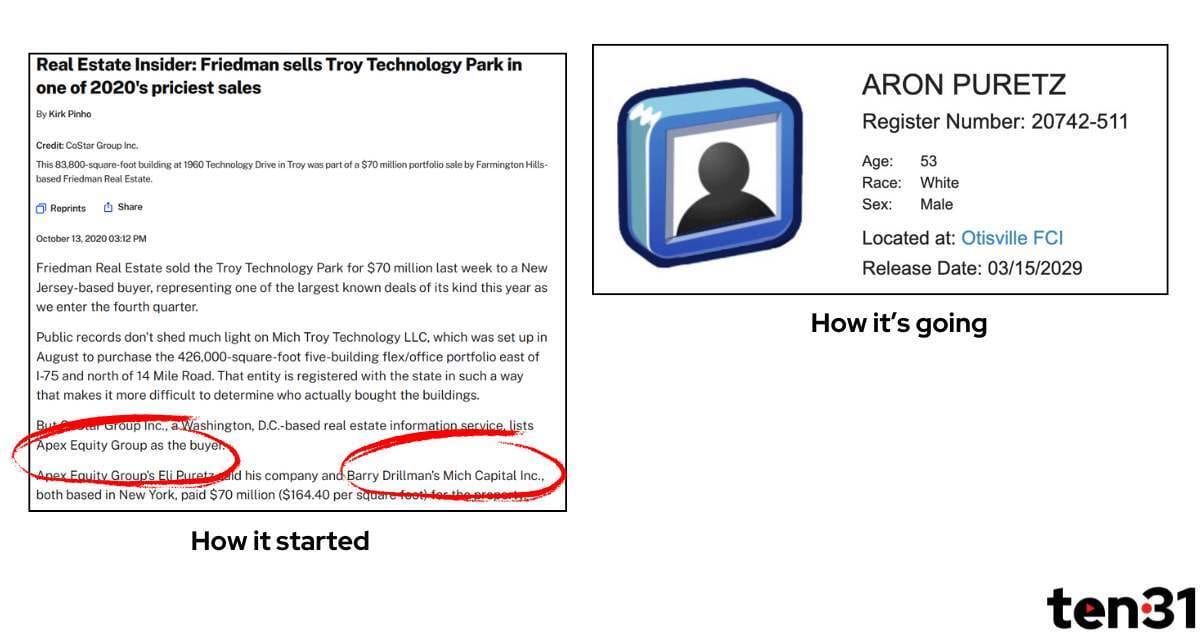

Life Comes at You Fast: CRE Fraud Edition

Aron Puretz, one of the central figures in CRE’ mortgage-fraud scandal, is now in Otisville prison

This is not news as such – we knew Aron Puretz was going away for wire fraud, after a judge hit him w/ the max. possible sentence in Dec. (highlights from sentencing here). But it hits different when you see the prisoner registry like this 👆. Let’s see how co-conspirator Barry Drillman’s 🚬 sentencing goes – Drillman’s lawyer Jeffrey Lichtman (prev clients: El Chapo, Fat Joe) has requested until 3/21 to respond to the prosecution’s report.

Arbor CLOses Two Out

This one’s worth watching…Arbor Realty Trust landed a $1.15B loan repo facility w/ JPMorgan, transferred $1.34B from 2 existing CLOs into the facility, and said bondholders will be paid in full 😮💨 . The health of Arbor’s CLOs is a subject of much market chatter – the firm was among the biggest financiers of the multifamily syndicator boom, and has acknowledged some distress on that front. Arbor’s overall CRE CLO distressed rates as of last summer were 5%, per a CRED iQ crunch, which also noted at the time that the lender had the 2nd-highest outstanding deal balance and the 2nd-highest rate of loan mods. The 8-K on this will be 👀

Quickies

Blackstone, Fisher shopping for $820M debt on 1345 Ave of the 🇺🇸 (meaning Fisher’s staying in, JPAM’s 49% is what BX bought)

Shvo scores 💼 Morgan Lewis as Transamerica Pyramid tenant (more on Shvo here – has anyone ever rocked a black tee harder?)

Purim bailout incoming? Chabad at risk of losing Fifth Ave home

Done at last: A&E pays Soloviev $117M for UES rental

RXR/SLG/NY REIT land mod for $940M Worldwide Plaza loan (more color on ownership tussles at the tower at 14:20 in our podcast)

Unquotable Quotes

“Personnel change is inevitable when you are expanding your value proposition.” 🤟

- CrowdStreet, the platform at the ❤ of CRE’s biggest crowdfunding scam, on HR shuffles 🩰

Happy Purim! A member of the ten31 tribe shared this gem